🗓️

2025

The AI Energy Stack

⚡ The Solar Power Trade

If AI is the brain of the new economy, the Electric Slide thesis says the stack underneath it looks like this:

Energy – cheap, abundant electrons

Intelligence – models, GPUs, data centers

Action – robots, EVs, chips, factories in motion

Packy McCormick’s The Electric Slide makes a pretty simple but brutal point: whoever controls that full stack – especially the energy and hardware layers – controls the future.

China has spent the last decade quietly going all-in on this. The U.S. is trying to speedrun the same thing, but it’s doing it with AI-first, energy-last sequencing, and a federal policy mix that’s… not exactly friendly to large-scale solar buildout.

At the same time, AI data centers are about to set the grid on fire (figuratively, hopefully).

Somewhere in that mess sits a potentially mispriced trade:

Solar as the cheapest scalable power source for AI + electrification

TAN ETF as a blunt, diversified way to own that theme

A focused basket of “picks and shovels” names from the Macro Meets Micro playbook (NXT, STEM, FSLR, WOLF, UUUU, etc.) as higher-beta expressions

This post is my attempt to tie together:

The Electric Slide (energy → intelligence → action)

U.S. vs China in the AI–energy race

The Raoul Pal In Focus: Solar thesis

Specific, implementable expressions: TAN + a small, concentrated energy sleeve

1. Why Energy Just Got Upgraded From Boring Utility to Core AI Infrastructure

Packy’s Electric Slide argument in one line:

The next S-curve isn’t just software eating the world. It’s electrons, GPUs, and robots eating the world together.

On the energy side:

AI data centers are already consuming ~4–5% of U.S. electricity; serious analysts see that rising toward double-digit percentages over the next decade as gen-AI, agents, and 24/7 inference go mainstream.

Brookings estimates that AI and data centers could drive U.S. electricity demand up 6.7–12% by 2028, and AI could consume up to 21% of global electricity by 2030 if growth continues at current trajectories.

Data centers aren’t optional. They’re becoming the base layer for everything from finance to defense to industrial automation.

We’re effectively building a second industrial grid on top of the existing one – but faster than we built the first.

That raises a basic question:

If AI is non-negotiable, what is the lowest-cost, fastest-scaling way to feed it?

2. Elon, Packy, and Raoul: Solar as the “Obvious” Answer

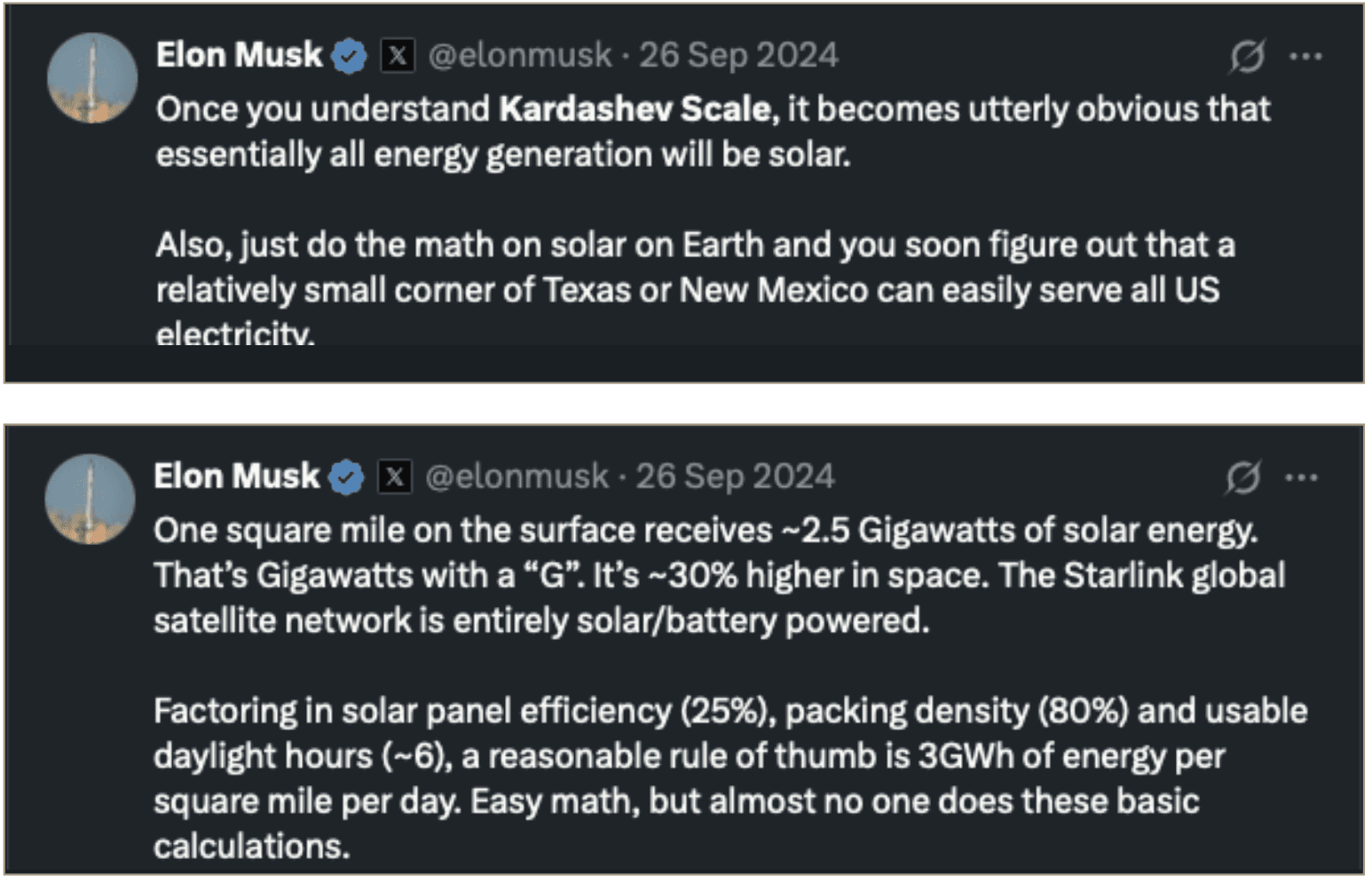

Elon Musk has been weirdly consistent on this for over a decade:

In a talk at Oxford’s Martin School, he flatly said:

“I’m confident solar will be the single largest source of energy for humanity in the future.”

At the National Governors Association, he laid out the simple mental model:

You could power the entire U.S. with roughly 100 miles by 100 miles of solar, plus about a 1x1 mile battery park to firm it up.

Add Packy’s framing, and it gives you a clean thesis:

Solar is the most scalable incremental power source for the AI stack:

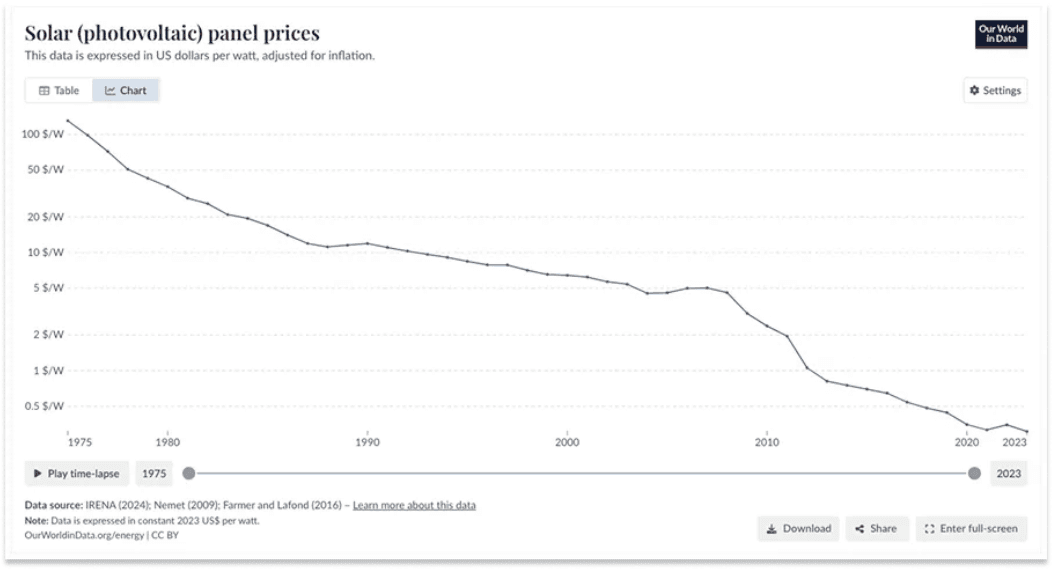

Costs have fallen ~90% over the last 15 years.

Utility-scale solar is already at or below new gas peaker costs in many regions, even before subsidies.

Solar pairs naturally with batteries and AI:

You get cheap daytime electrons.

You use batteries + AI-optimized dispatch to make that power effectively “firm.”

Raoul’s macro setup builds on this:

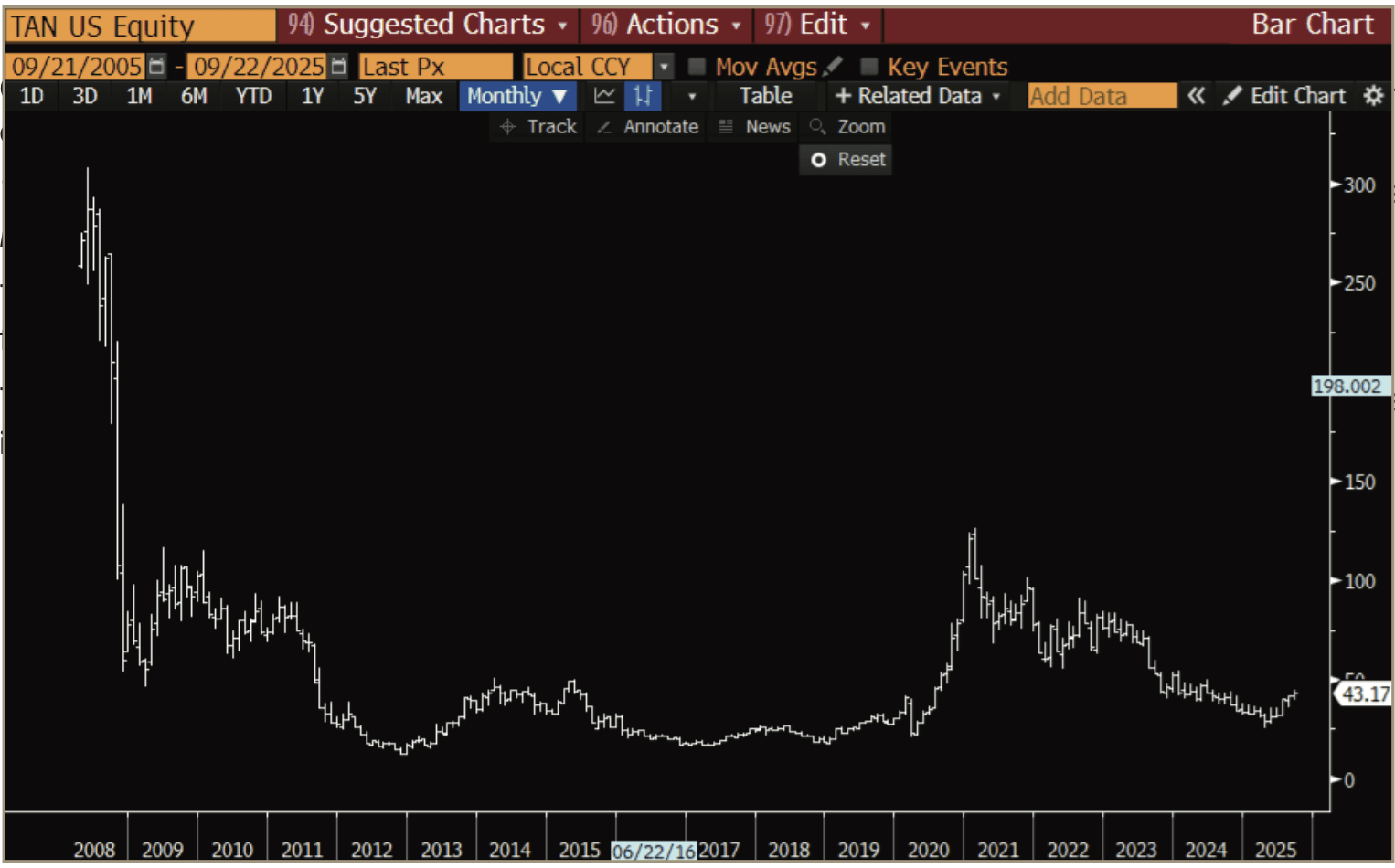

Solar equities have gone through a huge boom-bust:

Massive post-COVID hype and capex.

Rates shock + policy uncertainty + oversupply → brutal derating.

Meanwhile:

AI + electrification are structurally increasing demand for cheap, clean power.

The underlying technology keeps getting cheaper and better.

His conclusion: the solar complex is set up like prior classic macro trades – wrecked sentiment, improving long-term fundamentals, and a growing demand overhang – with TAN as the clean index expression.

So we’ve got:

Packy: “The brain needs electrons.”

Elon: “Solar should be the dominant source of those electrons.”

Raoul: “The market still prices solar like a busted theme.”

That’s an interesting place to hunt.

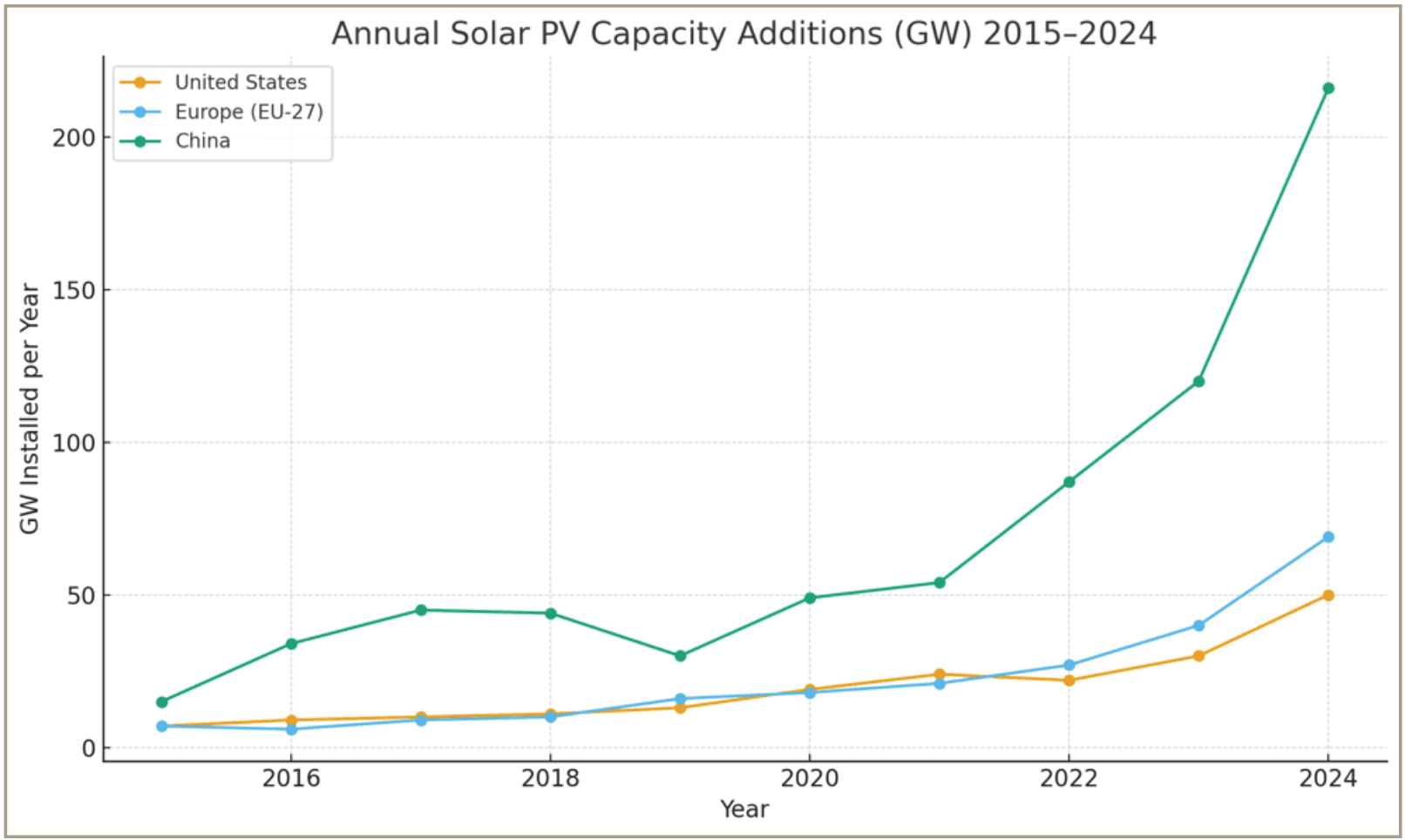

3. The U.S.–China Energy Map: Who’s Actually Doing the Electric Slide?

China: Building the full stack in sequence

China has spent years doing the boring, heavy stuff:

Dominates solar manufacturing (polysilicon, wafers, cells, modules).

Built 162+ square miles of solar on just one plateau installation alone, plus huge wind and hydro fleets.

Aggressively expanded transmission, batteries, and easy permitting.

They’ve basically pre-built a huge chunk of the energy + hardware layers of the Electric Slide:

Cheap solar → cheap hardware → cheap AI → cheap “action” (robots, EVs, fabs).

U.S.: AI sprint, energy drag

The U.S. is leading in:

AI models

Hyperscale data centers

Chips (NVIDIA et al.)

But on energy policy, the current administration is pulling in the opposite direction of a solar super-cycle:

A few key reasons:

The “One Big Beautiful Bill Act” rolled back clean energy credits

Deloitte’s 2026 Renewable Energy Outlook notes that the One Big Beautiful Bill Act (OBBBA) has:

Shortened qualification windows for key wind/solar credits.

Tightened requirements (continuous construction, FEOC rules).

Pulled forward timelines, making projects race to “safe harbor” rather than build on a calm, long-dated schedule.

Result: developers face compressed timelines + higher financing risk just when we want more renewables to serve AI.

Tariffs + new rules are raising solar and data center costs

The same Deloitte piece and Brookings’ work on data centers both highlight aggressive tariffs and foreign entity of concern (FEOC) rules on solar, batteries, and critical materials, raising project capex and supply-chain risk.

Brookings notes new tariffs on copper, steel, and aluminum – with some rates pushed to 50% – materially increase data-center and grid buildout costs, including for renewables.

Forecasted solar deployments have been cut

A September 2025 report from SEIA + Wood Mackenzie, covered by Reuters, says:

The U.S. solar industry is now expected to install 27% less capacity between 2026–2030 than was forecast before Trump’s tax law.

Utility-scale solar costs are already creeping up (low- to mid-single digit % increases) due to tariffs and permitting overhead.

So you have:

AI policy: “We want to be #1 in AI, build all the data centers, and onshore the stack.”

Energy policy: “Let’s make the cheapest form of new power (solar) more expensive and harder to build at scale.”

That mismatch is the opening for investors:

The U.S. needs more cheap, flexible, low-carbon power for AI.

Federal policy is slowing the obvious answer (utility solar + storage).

Over time, either policy adjusts or the system breaks. Both paths are volatile; both create opportunity.

4. What Options Does the U.S. Actually Have for AI Power?

Think in simple buckets:

Solar + Storage (fastest, modular, falling cost curve)

Pros: lowest marginal cost, highly scalable, quick to deploy, pairs well with AI-optimized demand response and batteries.

Cons: intermittency, land use / NIMBY, policy and trade risk.

Nuclear (clean baseload, slow to move)

Pros: 24/7 clean power, politically popular again in many circles.

Cons: long lead times, permitting hell, public risk perception, cost overruns. Data-center-specific nuclear (SMRs, restarts like Three Mile Island for Microsoft) will matter, but won’t solve the near-term gap alone.

Natural gas (bridge fuel)

Pros: fast to dispatch, existing infrastructure, politically entrenched.

Cons: volatile fuel price, emissions, and potential regulatory tightening later.

Grid upgrades + storage + software

Pros: unlocks stranded renewables, improves reliability, creates “virtual power plants” by aggregating distributed resources.

Cons: still slow to permit, politically messy (transmission siting), not a standalone energy source.

Critical materials (rare earths, uranium, copper, etc.)

Not a power source, but a chokepoint that determines whether nuclear, renewables, and electrification are even buildable at scale.

Andreas Steno from Real Vision, in his Macro vs Micro report, makes two big points that resonate with this:

Solar is the only renewable that has already proven it can scale fast enough to meaningfully close the AI energy gap.

But the bottlenecks now live in the plumbing:

Tracking systems (NXT, ARRY)

Inverters and optimization (SEDG)

Software + storage (STEM)

Critical materials and uranium (UUUU, CCJ, WOLF, etc.)

That’s where interesting opportunities may lie.

5. TAN: The Blunt Solar Bet

If you buy the macro:

“AI + electrification = structurally higher demand for cheap electricity, and solar remains the lowest-cost, fastest-to-scale option over the next decade.”

…then Invesco Solar ETF (TAN) is the simple, one-ticker expression.

What TAN gives you:

Global solar value chain exposure:

Panels, inverters, developers, trackers, balance-of-system names.

Diversification across U.S., Europe, and Asia, which matters given:

U.S. policy risk and tariffs.

China’s dominance in manufacturing.

A natural beneficiary of any policy “snap-back”:

If/when the U.S. realizes it can’t meet AI + electrification goals while kneecapping solar, any move to restore credits or relax tariffs should flow into the whole complex.

Where TAN fits in a portfolio:

We treat TAN as the core solar sleeve:

Position sizing: think in terms of 1–3% of overall liquid net worth for a “this might be a multi-cycle theme, but timing is noisy” trade.

Time horizon: 3–7 years, not a “trade the next quarter of rate cuts” position.

Expect volatility: this thing can easily swing 30–50% around the macro narrative.

6. Sharper Tools: Individual Names

Andreas Steno has done some great work here. There are a few high-leverage ways to express the same thesis more specifically. Think of these as TAN’s high-beta children.

6.1 Solar “picks and shovels” for the AI buildout

Nextracker (NXT, USA) – Tracking systems for utility solar

Builds the tracking hardware that lets panels follow the sun and juice output.

Already deployed at gigawatt scale globally.

Direct beneficiary of:

Utility-scale solar growth

AI data center PPAs that demand high-capacity-factor solar + storage

Risk: project timing, capex cycles, policy.

Stem Inc. (STEM, USA) – AI for energy storage + optimization

Software + storage platform that integrates batteries with solar to balance the grid and provide firm power.

Exactly the sort of infrastructure you need when:

Load is spikier (AI, EVs, heat pumps).

Supply is more variable (solar, wind).

Honorable mentions:

Array Technologies (ARRY, USA) – another large solar tracker vendor.

First Solar (FSLR, USA) – U.S. thin-film panel manufacturer with strong policy tailwinds and technology defensibility.

SolarEdge (SEDG, ISR) – inverters + optimization hardware/software (more cyclical, more bruised recently).

These are direct plays on “solar as AI’s favorite friend”.

6.2 Critical materials + uranium: powering the rest of the stack

Energy Fuels (UUUU, USA/CAN) – Rare earths + uranium

U.S./Canada-focused miner with:

Uranium processing capacity

Growing rare earths capabilities

Positioned as one of the only U.S.-listed names that can hit both:

China dependency on rare earths

Russia dependency on uranium

Sibanye Stillwater (SBSW, ZAF) – Platinum group + battery metals

Diversified exposure to battery and critical minerals via a South African producer.

Honorable mentions in that same cluster:

Wolfspeed (WOLF, USA) – silicon carbide semis, critical for high-efficiency power electronics and EVs.

Stem (again, STEM, USA) – appears here as a grid optimization/storage name.

Cameco (CCJ, CAN) – a large uranium producer.

The idea here isn’t “uranium bro” levels of conviction; it’s:

If AI + electrification + reshoring is real, critical materials and power electronics are a structural bottleneck with geopolitical premium.

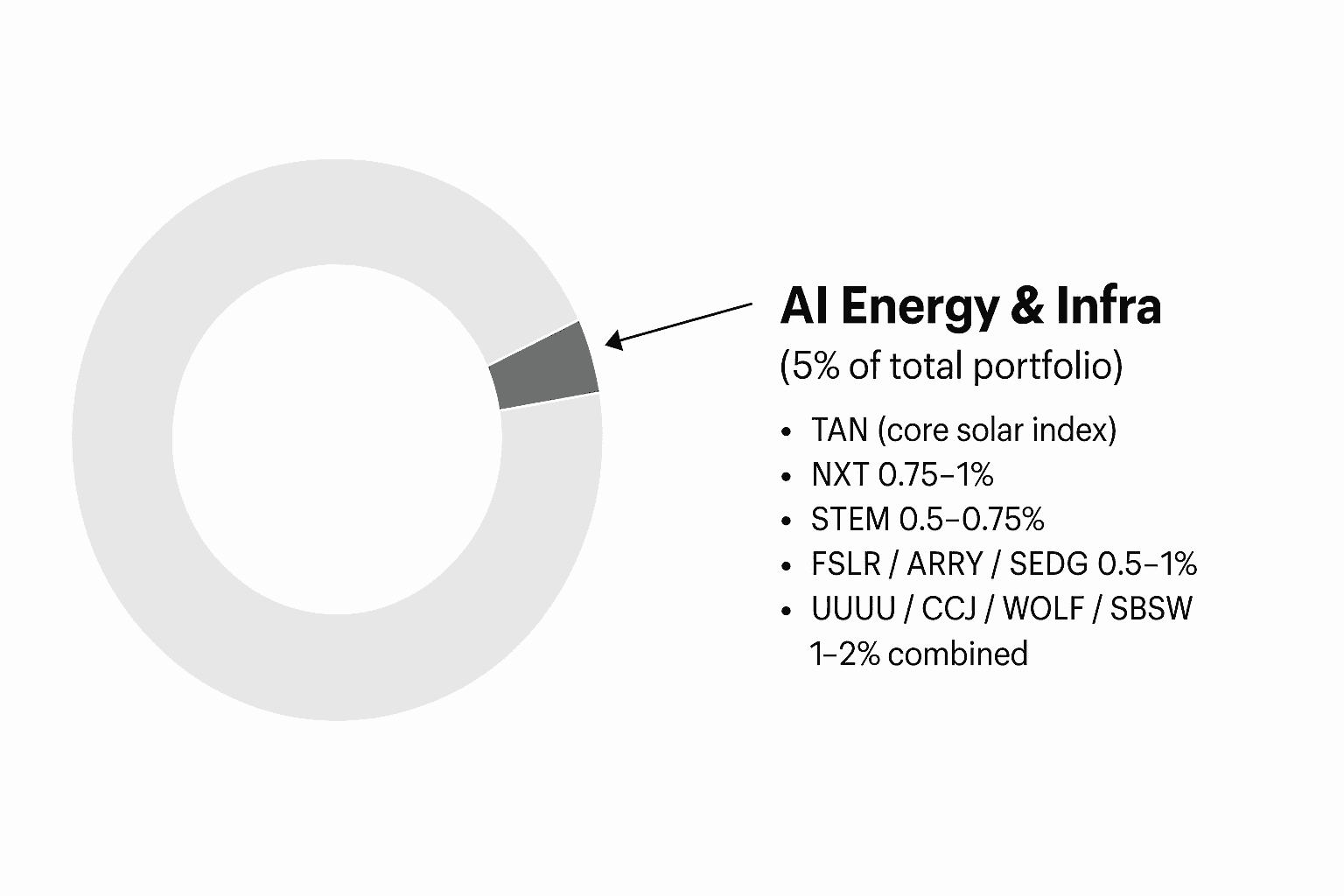

7. How I’d Actually Build the Sleeve

None of this is financial advice, etc., but if I were building a focused “AI energy” sleeve inside a broader portfolio, I’d think about it like this:

7.1 Structure

Within your overall liquid portfolio:

Core AI / chips / software – already likely sizable (NVDA, MSFT, etc.).

This sleeve: AI Energy & Infrastructure at, say, 3–7% of total portfolio, broken roughly into:

50–60% TAN (core solar index)

40–50% single names from the Macro Meets Micro basket

Example mix (you can tweak):

TAN – 3–4% of portfolio

NXT – 0.75–1%

STEM – 0.5–0.75%

FSLR or ARRY or SEDG – 0.5–1% combined, depending on your taste for cyclicality

UUUU + CCJ + WOLF + one critical-materials name (e.g., SBSW) – 1–2% combined

The logic:

TAN gives broad solar beta if we are right about the cycle.

NXT/STEM/etc. add targeted leverage to AI-linked solar buildout.

UUUU/CCJ/WOLF/etc. gives exposure to the under-the-hood hardware and fuel that enable solar, nuclear, and the grid.

7.2 Time horizon & risk

This is not a “trade the next Fed meeting” basket.

It’s more like:

3–5 year horizon

Expect:

Factor volatility (rates, growth scares)

Policy rug-pulls (credits, tariffs, FEOC rules, permitting)

China–U.S. trade twists

The upside case is simple:

AI + electrification outgrow today’s grid, policy eventually bends toward reality, and solar + enabling infrastructure re-rate off deeply discounted levels.

The downside case is also simple:

Rates stay high, policy stays hostile, and solar remains structurally handicapped; TAN and the satellites remain value traps.

Or nuclear / gas / some new tech (e.g., super-cheap long-duration storage) ends up capturing a disproportionate share of the new AI load.

8. What Could Break This Thesis?

Three categories of risk I’d keep front-of-mind:

Policy path-dependence

If the current U.S. administration doubles down on:

Further rolling back credits.

Tougher FEOC rules and tariffs.

More permitting friction, not less.

…you could see:

A slower, more expensive solar buildout.

Capital shifting even more aggressively to nuclear + gas + elsewhere (Europe, Middle East, LatAm, etc).

TAN and U.S. solar names are obviously most exposed.

Technology curve surprises

Big nuclear breakthrough (e.g., SMR cost curve really bends).

New storage tech that makes renewables extremely firm at low cost, but value accrues more to the storage layer than the solar layer.

Some wild-card like cheap geothermal in specific regions.

These don’t kill solar, but they can change where the best risk-adjusted returns sit in the stack.

Overbuild / bust cycles

This setup is a classic cycle – and classic cycles overshoot both ways:

If capital floods back into solar on AI hype, the industry can overbuild again.

Margins get crushed, and equity returns lag the macro story.

That’s another reason to keep TAN + a basket, not just one or two “hero” names.

9. Wrapping It Up

If you zoom out:

The Electric Slide says the winners of this era will own energy + intelligence + action.

China pre-bought its way into that advantage with a decade of buildout.

The U.S. is trying to sprint to AI dominance while half-throttling the cheapest power source that can sustain it.

Elon Musk has been saying for ten years that solar is obviously the end state, and Raoul Pal is effectively saying the market is still pricing solar like the past cycle, not the next one.

So the question isn’t:

“Will solar matter?”

It’s:

“Can you structure exposure so you survive the policy noise and cycles long enough to let the AI + electrification demand curve do its thing?”

For me, that looks like:

TAN as the core, time-horizoned to the AI + energy buildout.

A focused set of enablers – NXT, STEM, FSLR/ARRY/SEDG, UUUU/CCJ/WOLF/SBSW – as the higher-beta satellites.

Always remembering this sits inside a broader AI + macro framework, not as a standalone “miracle trade.”