Bittensor (TAO) Memo

⚡ The Monetary Layer of Intelligence

1) Executive Summary

Thesis: TAO is emerging as the monetary primitive for decentralized AI, with Dynamic TAO (dTAO) turning emissions into a market for intelligence. If subnets deliver real utility, TAO’s structurly aligned architecture accrues value reflexively (emissions → utility → demand → emissions).

Why Now: The dTAO upgrade (Feb ’25) introduced alpha tokens per subnet + on‑chain AMMs, shifting allocation from validator votes to market‑driven signals. This can create a flywheel if winning subnets attract stake, raise alpha prices, and pull more TAO emissions.

Positioning: Core/Satellite. Core = TAO (infrastructure money). Satellites = TAO.BOT (picks & shovels; ETH on‑ramp + LSTs) + select Subnets with real usage.

2) What It Is (Plain‑English explainer)

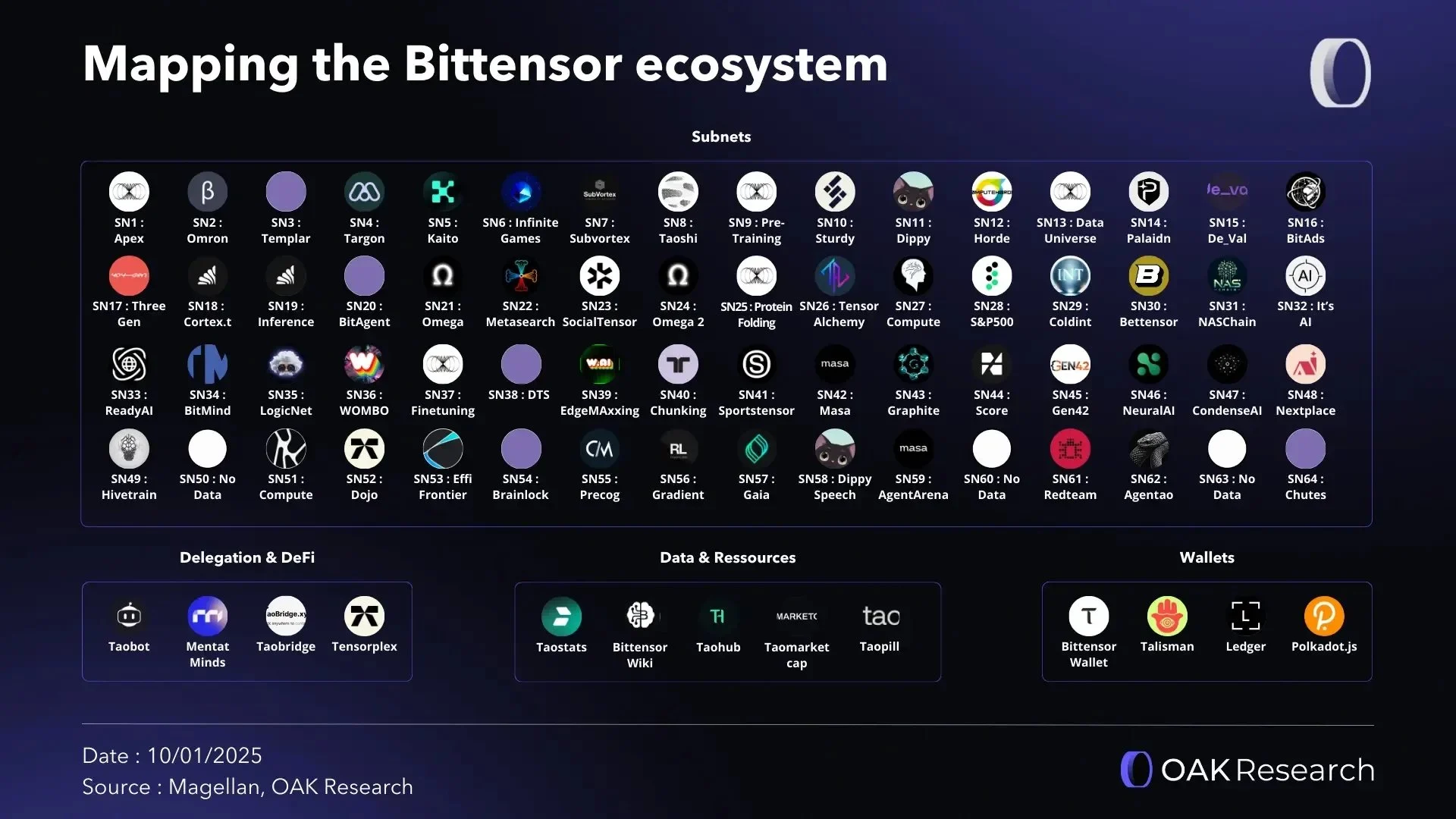

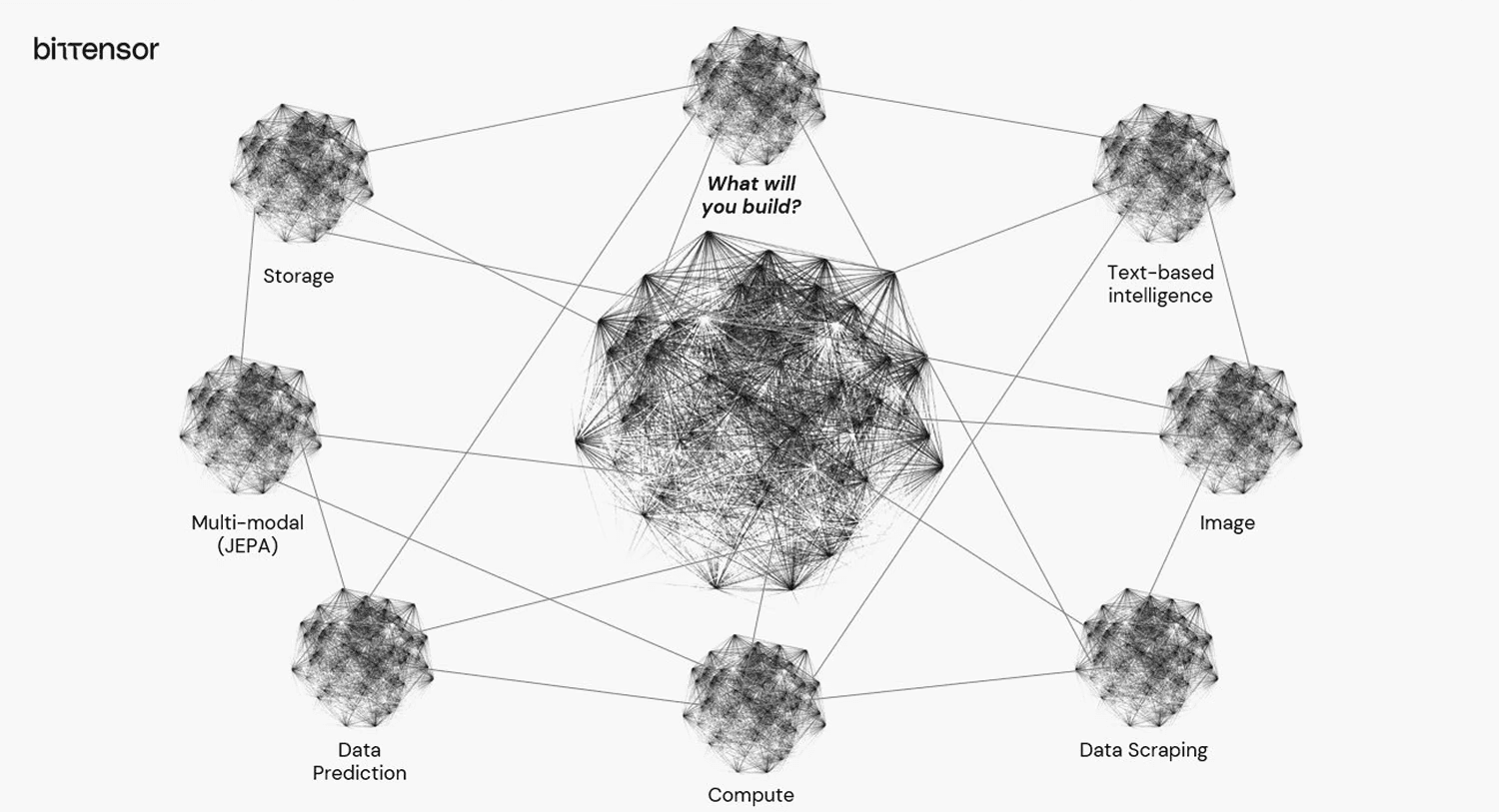

Think of Bittensor as an app store for AI. Each subnet = an app, with its own alpha token “shares.”

You “buy shares” in an app by staking TAO into its pool, which swaps your TAO for that app’s alpha token.

Validator scoring, briefly: Validators grade subnets results and assign weights; combined with each subnet’s alpha price, this determines how much reward that subnet receives.

Prefer a simpler, lower-volatility path? Stake Root (Subnet 0) to earn TAO. Want targeted exposure to specific services? Stake the relevant subnet to earn its alpha token.

3) Core Investment Thesis

Unique Narrative power (AI × Crypto):

Narrative white space: AI × money is still uncrowded. Crypto is the only sector where AI still has primitive white space. TAO could become the native money of AI coordination.

Scarcity compression: 21M hard cap, >40% emitted, no VC unlocks.

Reflexive loop: emissions → utility → TAO demand → emissions.

Institutional anchoring: public‑company balance‑sheet buys, subnet buildout, treasury positioning.

Reflexivity by design:

TAO’s design routes more demand toward TAO as more subnets launch. Greater TAO demand raises subnet value, which pulls in more builders, which creates more useful subnets, which requires more TAO again.

Loop intuition: Utility → demand → price → more utility. The reflexive engine is structural (emissions, auctions, alpha pricing), not just narrative belief.

Callout — Reflexivity by design, not belief. dTAO auto‑routes emissions toward winning subnets via alpha price. Winners attract stake and builders, compounding utility → demand → price → utility.

4) Why Now: The dTAO Flywheel

Market‑driven allocation: Alpha price ↑ → TAO injection ↑ → more rewards for that subnet → attracts builders & capital → alpha price ↑ again.

Cleaner incentive design: Builders must win stake with results, not just relationships.

Institutional rails forming: Custody, staking, and data/compute partners are emerging around TAO—tight float with growing stake share amplifies moves.

Halving clock: Supply issuance halves on schedule (next ~Dec 25), tightening effective float while dTAO funnels emissions toward winners.

5) Catalysts

Functional wins in subnets (cheaper inference, agent economies, GPU rentals, vertical research) turning into visible usage/revenue (e.g., SN51/Celium $1M+ in 5 months per GCR and OAK Research).

Bridged liquidity & UX (ETH on‑ramps, liquid staking of α/TAO) lowering friction for non‑native users. (see TAOBOT)

Narrative ignition (AI × money), especially if centralized AI policy shocks push interest to decentralized rails.

6) Risks (condensed)

Subnet utility dependency: TAO needs subnets that deliver real products; otherwise emissions chase speculation.

Economic experiment: dTAO is young; gaming/exploit and dilution dynamics (alpha issuance vs. TAO flows) are still being tuned.

Scaling/latency & gas: Performance variances under load can dent UX when subnets spike activity.

Stake concentration: Large holders or validator clusters can still tilt outcomes.

Regulatory/centralization shocks: Policy, custody, or exchange access changes can hit flows; centralized AI keeps improving (relative performance risk).

7) Projection Analysis — Scenarios (independent)

Assumption levers (you can tune these)

Adoption: growth in Sum of Alpha Prices (SoAP) and % TAO staked

Utility: Subnet ERR (external revenue runrate) growth and ERR/Emissions ratio

Token flow: net TAO injection/extraction balance favoring winning subnets

Liquidity: alpha depth & turnover; bridging/UX improvements

Macro/Narrative: AI × money narrative intensity; institutional participation

Scenario matrix (12–30 month horizon)

Assumes spot TAO = $430 as of Oct 29, 2025.

Case | Prob. (ours) | Return Multiple | Implied TAO Price (spot $430) | What happens | Key drivers to watch |

|---|---|---|---|---|---|

Breakdown | 15% | 0.4×–0.8× | $172–$344 | Reflexive loop breaches; critical bug or centralized AI dominance stalls subnets; capital rotates out. | ERR stalls; SoAP flat/declining; Root APY spikes as alpha underperforms; policy headwinds. |

Base — Functional ignition | 45% | 3×–6× | $1,290–$2,580 | Subnets show durable utility; ERR/Emissions > 0.3 on top‑5 subnets; SoAP & % staked grind higher. | Top subnets’ ERR trend, emission share concentration, validator quality; bridging UX. |

Expansion — Belief onset | 25% | 10×–30× | $4,300–$12,900 | Narrative catches; institutional rails + ETPs; SoAP accelerates; subnet auctions heat up. | Public co. treasuries; LST TVL; liquidity migration from ETH via gateways. |

Bull — Reflexive detonation | 15% | 50×–100× | $21,500–$43,000 | Policy shocks or major wins (agent economies, GPU rentals at scale) drive auction demand & TAO scarcity; feedback loop rips. | ERR hockey‑stick; alpha liquidity deepens; auction/registration costs surge across winners. |

Disclosure: Scenarios are illustrative, not price targets. They hinge on external revenues, validator discipline, and policy.

8) Example Allocation Strategy (core/satellite)

Core (60–75%) — TAO

Rationale: Base asset of the network; captures system‑level reflexivity; simplest exposure via Root staking for TAO yield.

Execution: Acquire on major CEXs; withdraw to TAO wallet; stake on Root across 2–3 reliable validators to diversify.

Satellites (25–40%)

A) Picks & Shovels (10–20%) — TAO.BOT

What: Front‑end DEX/explorer for subnet tokens with ETH Entry Gateway (fast EVM on‑ramp) and planned LSTs (liquid staking for α/TAO).

Why: If bridging UX + LSTs drive flows, TAO.BOT can monetize order flow and LST fees; “index‑like” exposure to subnet activity without picking winners.

B) Subnets (10–20%) — a small basket

Pick 2–4 by category and size small:

Compute/GPU rental: e.g., a Celium‑type subnet (real external revenue, off‑chain demand).

Inference/Search: high emission share + liquidity depth; proven validator set.

Prediction/Finance (Taoshi‑type): clear use case; open metrics.

Sizing: Start tiny per subnet (e.g., 1–3% each) until alpha price, emission share, and usage show persistence.

Position risk note: Alpha is volatile and exits have slippage. Treat satellites as venture risk inside the TAO ecosystem

9) How We’ll Measure It

North Star — Subnet ERR (External Revenue Runrate)

What it is: The annualized $ revenue a subnet earns from paying users/services outside of TAO emissions.

Why it’s our North Star: Ties performance to real utility (not just token flows), signals product‑market fit, and supports durable alpha prices (which in turn attract more TAO injection). It’s also comparable across subnets and robust to emission/tuning changes.

How we’ll track it (practical): Use subnet disclosures (e.g., public revenue posts, pricing pages, invoices, and on‑chain fee addresses), mapped fee wallets, partner volume × price, and public dashboards where available. Record 30‑day run‑rate, QoQ growth, and cross‑check with on‑chain flows.

Supporting ratios:

ERR / Emissions → self‑sufficiency (how much external $ per $ of token emissions).

ERR / TVL (or Liquidity) → capital efficiency of staked capital.

ERR / Active UID → revenue per participant (operator quality).

ERR growth − Alpha issuance growth → net value accretion.

Caveat: Often self‑reported; verify methods and look for consistency over time.

Network‑level

Root APY (hourly extrapolated) trend

Sum of Alpha Prices (SoAP)

TAO Injected vs. Reserves

% of TAO Staked

Halving countdown & daily emissions

Circulating float (ex‑staked TAO)

Subnet‑level

ERR (External Revenue Run‑rate) — North Star; external $/yr (annualized) from paying users.

ERR / Emissions, ERR / TVL, ERR / Active UID — capital & operator efficiency.

Emission share rank — where the subnet sits in rewards distribution and whether share is rising.

Alpha price & liquidity depth — durability of demand + ease of exit (slippage risk).

Active UIDs & validator counts — participation and competitive pressure.

Registration cost & pruning rate — entry demand vs. churn/quality control.

Incentives & Dividends stability (Yuma) — consistency of miner/validator payouts over 7–30d.

10) Final Word — Ignition

If Bitcoin was neutral money for nation‑states, TAO is aiming to be neutral money for machine economies. As subnets prove real utility, dTAO’s routing turns utility → emissions → demand into a self‑reinforcing loop. The more useful the network becomes, the more coordination wants a single monetary substrate.

TAO as the monetary layer of decentralized intelligence. TAO as the outside option to centralized AI—what Bitcoin was to central banks. TAO as currency for intelligence.

If the flywheel ignites, everything accelerates.

-

Disclosures

Not investment advice; educational only.

Author may hold TAO, TAO.BOT, and/or subnet tokens; may stake or LP; positions may change without notice.

Forward‑looking statements; scenarios and price ranges are illustrative, not guarantees.

Data from public dashboards and project disclosures; ERR may be partially self‑reported—verify independently.

Digital assets carry significant risk, including potential total loss.

.