The Token Revolution

🧭 The future runs on tokens

TL;DR

Tokens are taking over—across money, identity, memory, and expertise. Crypto tokens, AI (LLM) “tokens,” and the other tokens you keep hearing about are not separate fads. They’re the same shift: making the world legible to software so helpful agents can work on our behalf. When tokens connect who you are (identity), what you own/owe (value), what you prefer/remember (memory), and what the system knows how to do (expertise), a powerful flywheel kicks in. The next wave of companies and institutions will win by supplying, building with, or orchestrating token factories—systems that mint, verify, and manage these tokens at scale.

Hat tip: much of this framing builds on Ribbit Capital’s Token Letter (June 2025) and NVIDIA's Jensen Huang’s earlier taxonomy/“tokens everywhere” lens.

Why this matters in plain English

First we put files online. Now we’re putting trust, money, and memory online. Tokens make the world machine-readable so agents:

Know who/what it’s dealing with (identity)

Move and enforce value (payments, assets, rights)

Recall context (your history and preferences)

Hook those three together and you get intelligent agents that can do real tasks, not just chat.

What is a token, really?

A token is a portable, countable unit a computer can verify without asking permission from a dozen siloed databases. Think of it as a barcode for the digital world—sometimes it represents you, sometimes your money or rights, sometimes your memory/context, and sometimes the chunks of language an AI thinks in.

Different tokens, same superpower: they make things portable, verifiable, programmable.

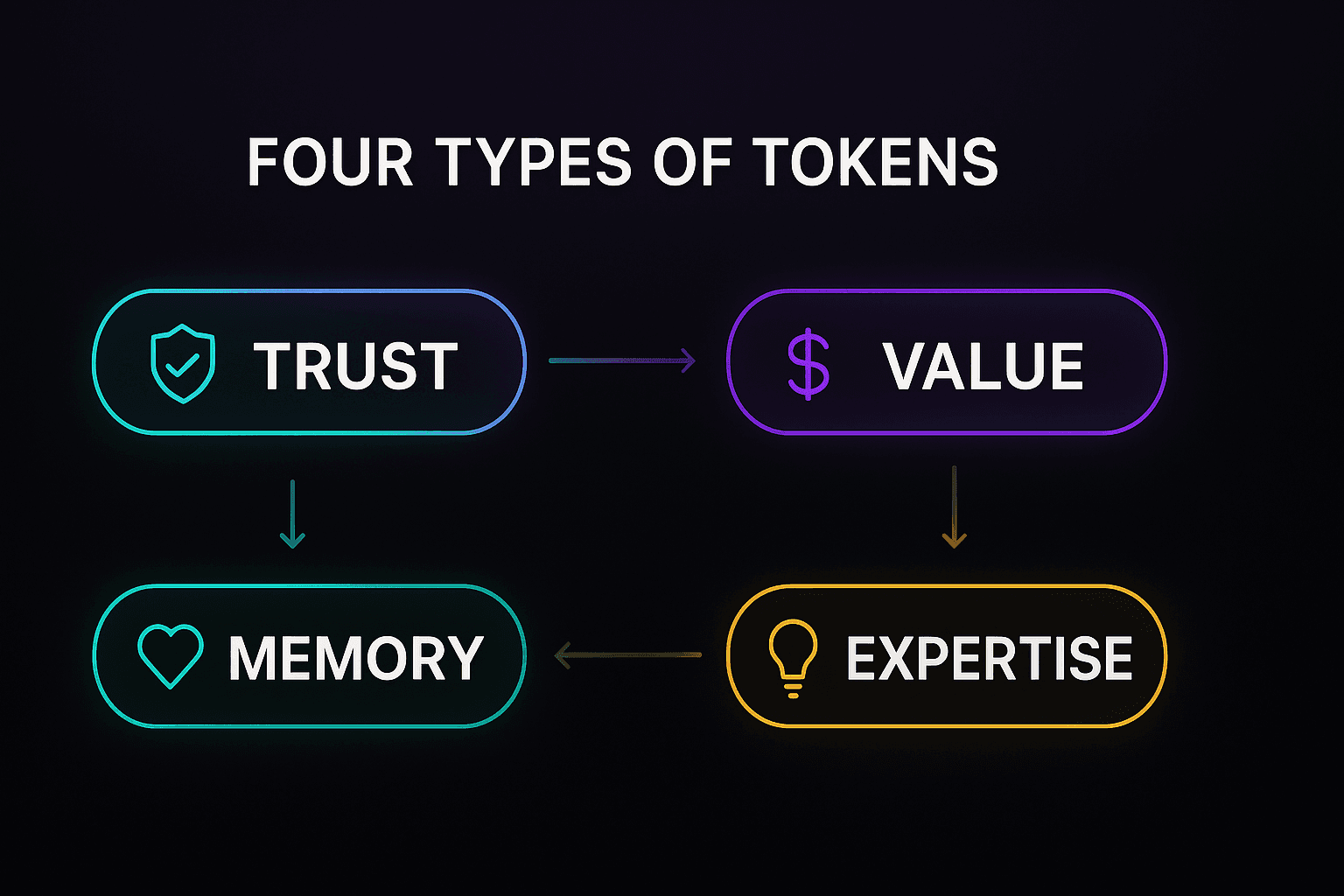

Four types of tokens

1) Trust tokens (Identity • Access • Context) — “Prove it in one tap.”

Examples: password-less login, tap‑to‑enter doors (phone as badge)

Accrual: network effects + fraud reduction → higher approval & conversion rates, larger average order value (AOV), more high‑trust actions unlocked.

2) Value tokens (Assets • Rights • Money) — “Software that holds and moves value.”

Examples: stablecoins, tickets, warranties, receivables, equity interests.

Accrual: float/fees + instant settlement → lower costs, new pricing (pay‑per‑use, refundable‑by‑rule).

Keep an eye out for— machine‑native payments (x402): revives HTTP 402 Payment Required so agents can pay APIs and services directly with stablecoins (instant settlement, account‑less, zero protocol fees).

3) Memory tokens (Portable preferences & history) — “My taste, to‑go.”

Examples: “EV charge to 80% max,” “always aisle on red‑eyes,” “auto‑rebuy running shoes every 5 months,” prior purchases.

Accrual: consented re‑use compounds outcomes → retention/LTV lift; hardest asset to copy.

4) Expertise tokens (Knowledge • Expert playbooks) — “Brains & workflows the agent rents.”

Examples: SOPs, domain checklists, model‑ready datasets; priced per use or outcome.

Accrual: measurable accuracy & coverage → usage royalties, renewals, and deepening data moats.

How do crypto and LLM tokens fit together?

AI models "think" in small text chunks called tokens—their unit of work. You pay per token to read/write/think. When models consume trust and memory tokens, and are allowed to spend value tokens, the conversation becomes action. That’s the bridge between AI and crypto...

LLM tokens meter intelligence/compute — the units models consume to read, write, and reason.

Trust/Value/Memory/Expertise tokens encode who/what, ownership, context, and know‑how so actions are authorized and personalized.

Concrete bridge: x402 carries the value token that pays the API or data vendor the agent just decided to use (HTTP handshake → 402 → pay → access).

Together, they let agents understand, decide, and transact.

NVIDIA explains what an AI ‘token’ is—the unit used to read, write, and reason.

Token factories: the new company/institution

One‑line definition: A token factory is a company or institution that turns a request ("do X") into a finished, auditable outcome by creating, refining, and combining tokens—so identity is verified, policy is applied, value moves, and memory updates. In conventional terms: factories transform tokens into more valuable tokens (i.e., higher levels of usable intelligence).

Why this matters: As the world becomes machine‑readable, every serious service—banks, retailers, hospitals, agencies—needs a reliable way to mint, verify, manage, and deploy tokens so agents can act safely on our behalf.

Two shapes of factories:

General‑purpose complexes (think large foundation models): handle a wide range of inputs and produce many kinds of valuable outputs.

Deeply specialized lines: built on unique training data or domain playbooks (e.g., industrial materials, tax, clinical workflows) to do a specific job extraordinarily well.

How a token factory works (5 steps):

Intent in — a user or agent asks for something (e.g., “refund the shoes”).

Trust check — verify identity/access (trust token).

Policy & know‑how — apply the right playbook (expertise token) and rules.

Value move — move money/rights and generate a receipt (value token).

Memory update — record the outcome and preference (memory token).

Where companies slot in:

Suppliers — sell the parts: KYC/AML, passkeys & wallets, custody, compliance, policy engines, settlement.

Builders — embed tokens inside apps/agents (support, finance, travel, healthcare).

Orchestrators — run the whole line for a vertical (the “agent OS” for an industry).

Agents + factories: Agents will use—and often build—these factories. In plain English, agents are software systems that can perceive context, make decisions, take actions toward goals, and improve as they learn.

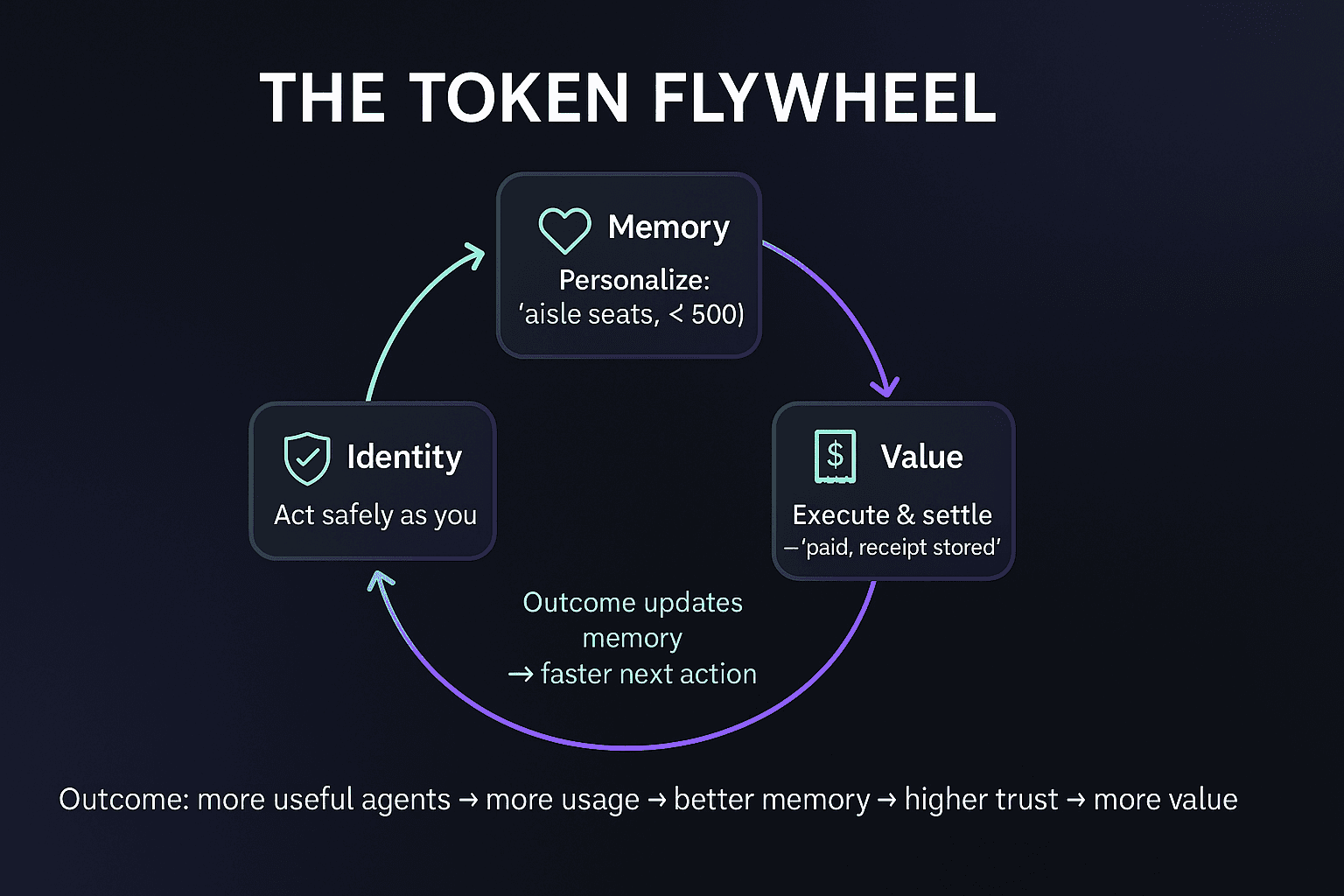

The Token Flywheel (in one picture)

Identity lets an agent act safely as you.

Memory personalizes the action (“book aisle seats, under $500”).

Value executes and settles (“paid, receipt stored”).

The result updates memory, making the next action faster and better. → Repeat.

Outcome: more useful agents → more usage → better memory → higher trust → more value flowing through the system.

Life moments

Groceries: Your household agent notices you’re low on paper towels, price‑shops, asks for FaceID to approve over $40, pays instantly, and drops the receipt in your budget.

Healthcare: Your insurance card becomes a token. At the pharmacy, your agent applies coupons, pays the copay, and schedules a reminder for refills.

Travel: “Find a nonstop Friday after 5pm, aisle seats together, under $600. Use travel credits if available. Ask me before booking.” Done.

Small business: A bakery’s agent invoices, reconciles payments, answers order emails, and processes refunds—all while the owner actually bakes.

How tokens accrue value (for products, platforms, and investors)

Network effects: More verified identities and connected merchants make each token more useful.

Reduced friction: Faster onboarding and settlement create measurable ROI (fraud down, cash conversion up).

Compounding memory: Every consented interaction improves personalization → higher LTV and retention.

Standards position: Winners often set or adopt the rails others must plug into.

Float & fees (for value tokens): Issuers and platforms monetize issuance, spread, or flow.

If you only remember one thing

Tokens are the connective tissue of the AI era. Identity proves who/what, memory carries context, value moves money/rights, and expertise supplies know‑how. LLM tokens meter intelligence—the thinking that turns conversation into action. Connect them and you unlock the agent dividend: real work done, safely, on your behalf.