🗓️

2025

NFTs...Hear Me Out

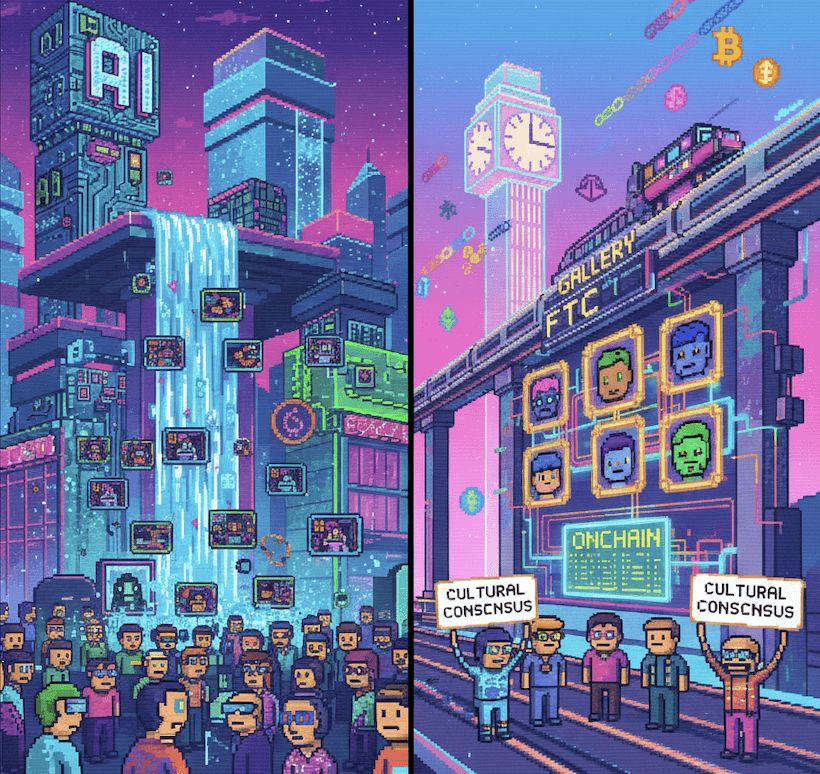

⚡ The Most Valuable Blockspace Is Culture

ⓘ What is this?

TURN SIGNAL — Bridge (Fourth → First)

Summary: AI makes content cheap; onchain provenance + portable identity become the premium. NFTs act as networked identity primitives—badges, memberships, and entitlements that travel across apps and chains. They also crystallize culture: onchain signals—who collects, displays, and funds—turn taste into data and identity.

Heat: 7/10 • Vector: Tailwind

Catalysts: ETH mainnet as cultural settlement; wallet-as-login (ENS, Passkeys); token-bound accounts (ERC‑6551); onchain storage norms; brand & museum registries; social display (X/Twitter, galleries).

Risks: beta to crypto liquidity; thin floors/illiquidity; royalty-policy drift; standard churn (identity/wallet standards); metadata durability.

Why this post, why now

NFTs have become shorthand for peak speculation. Fair. But the more interesting story is simpler: as AI makes content abundant, provenance and shared meaning become scarce. Onchain, networked art packages those scarce things into assets. That’s the core of our thesis and why we’re launching the FTC Gallery as a living example.

What I mean by “networked art”

Networked art is born onchain. It’s not just a file; it’s an addressable object with provenance, programmable rights, and a social life. It travels wallets, galleries, feeds, and markets in public. It also includes networked ownership—collector DAOs and syndicates—where membership NFTs represent shared ownership, curation, and governance (e.g., DoomDAO for XCOPY works). It composes with other primitives. It accrues meaning as people collect, display, and reference it—out in the open.

NFTs also function as networked identity—portable badges, memberships, and entitlements that follow the wallet and are readable by apps, galleries, and social surfaces.

Think of NFTs less as “pictures” and more as receipts of cultural consensus: who made it, when it was minted, where it lives, and who cared enough to collect

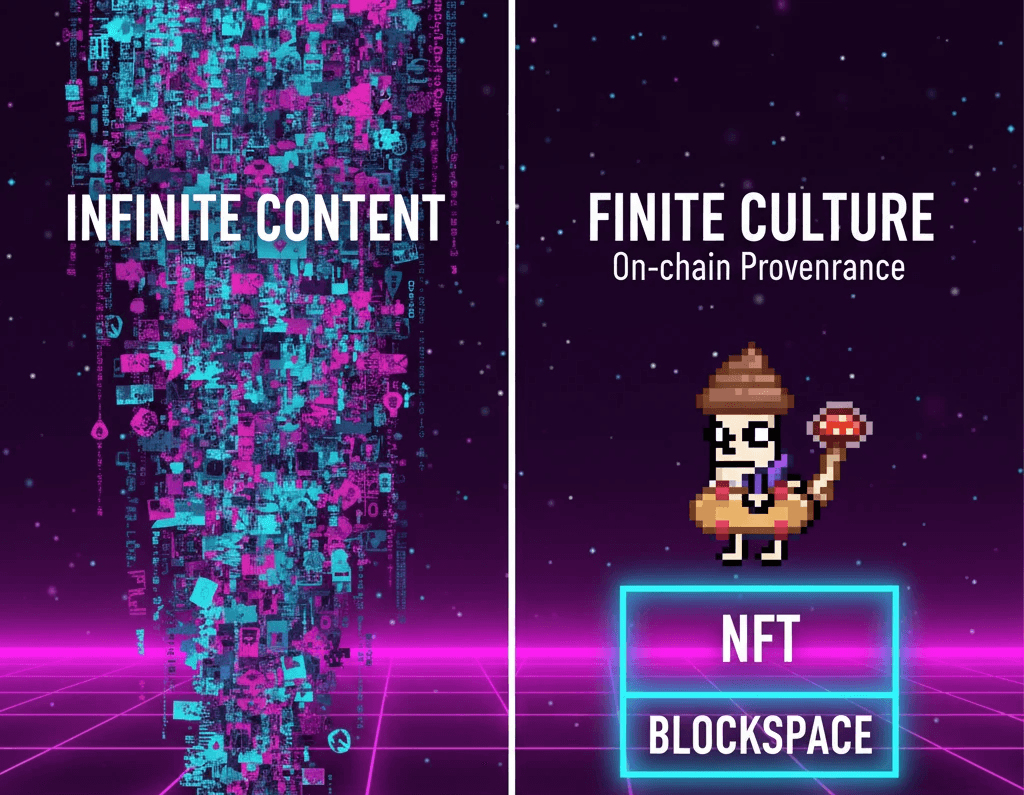

AI floods the zone; provenance becomes premium

We’re heading into an era where great-looking content is nearly free to produce. When content supply goes to infinity, the premium shifts to verifiable origin (provenance), credible scarcity, and network consensus. Onchain artifacts have all three. That’s the pivot: infinite content, finite culture.

Blockspace is the canvas (and not all canvas is equal)

If NFTs are cultural records, blockspace is the canvas they’re painted on. Security, permanence, and composability matter. An artwork fully onchain or with durable metadata anchored to a credible settlement layer tends to command a premium over time. In practice, we generally prefer Ethereum mainnet for canonical cultural records and long‑term provenance.

Featured from the FTC Gallery (with quick annotations)

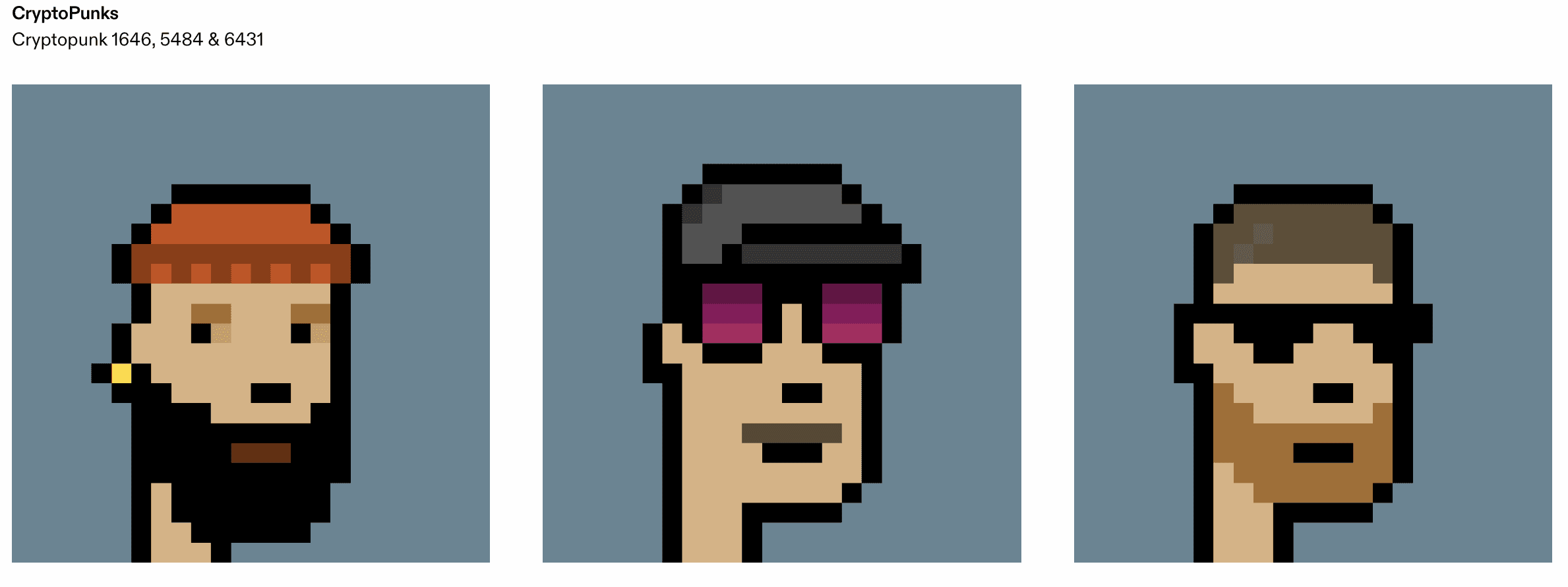

CryptoPunks — identity as culture

Why it matters: Punks are the OG onchain identity primitive. Early provenance, fixed supply, deep lore. Whether or not you “like” the pixels is beside the point—the network does. We treat Punks as the reference identity index in digital culture.

What we look for: clear provenance, clean attributes, sustained market depth, and museum/curatorial interest.

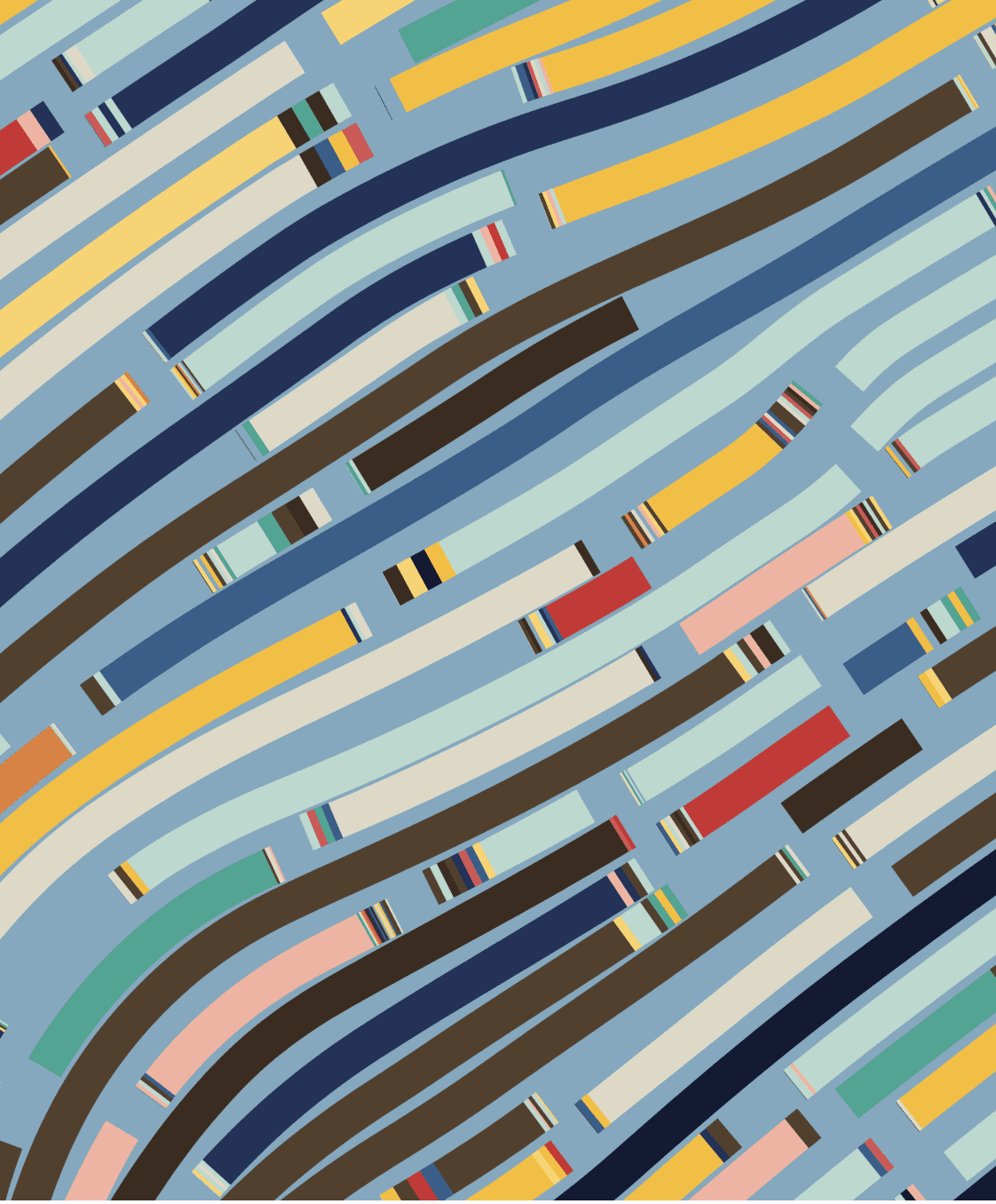

Fidenza (Tyler Hobbs) — code as the medium

Why it matters: Generative art isn’t art about code; it is code. Fidenza captures algorithmic aesthetics—flow fields, palette composition, and emergent structure—inside a canonical Art Blocks Curated set with strong collector scholarship.

What we look for: palette diversity, path density and balance, standout composition, and storage/mint characteristics (onchain script; durable metadata anchoring).

Chromie Squiggle (Snowfro) — the standard candle of gen art

Why it matters: Squiggles are the early, instantly recognizable signature of onchain generative culture—simple surface, deep parameter space (chroma, fuzz, type). They’re the Rosetta stone for learning the category.

What we look for: appealing chroma, interesting type (e.g., fuzzy/hyperrainbow), and provenance clarity within early Art Blocks history.

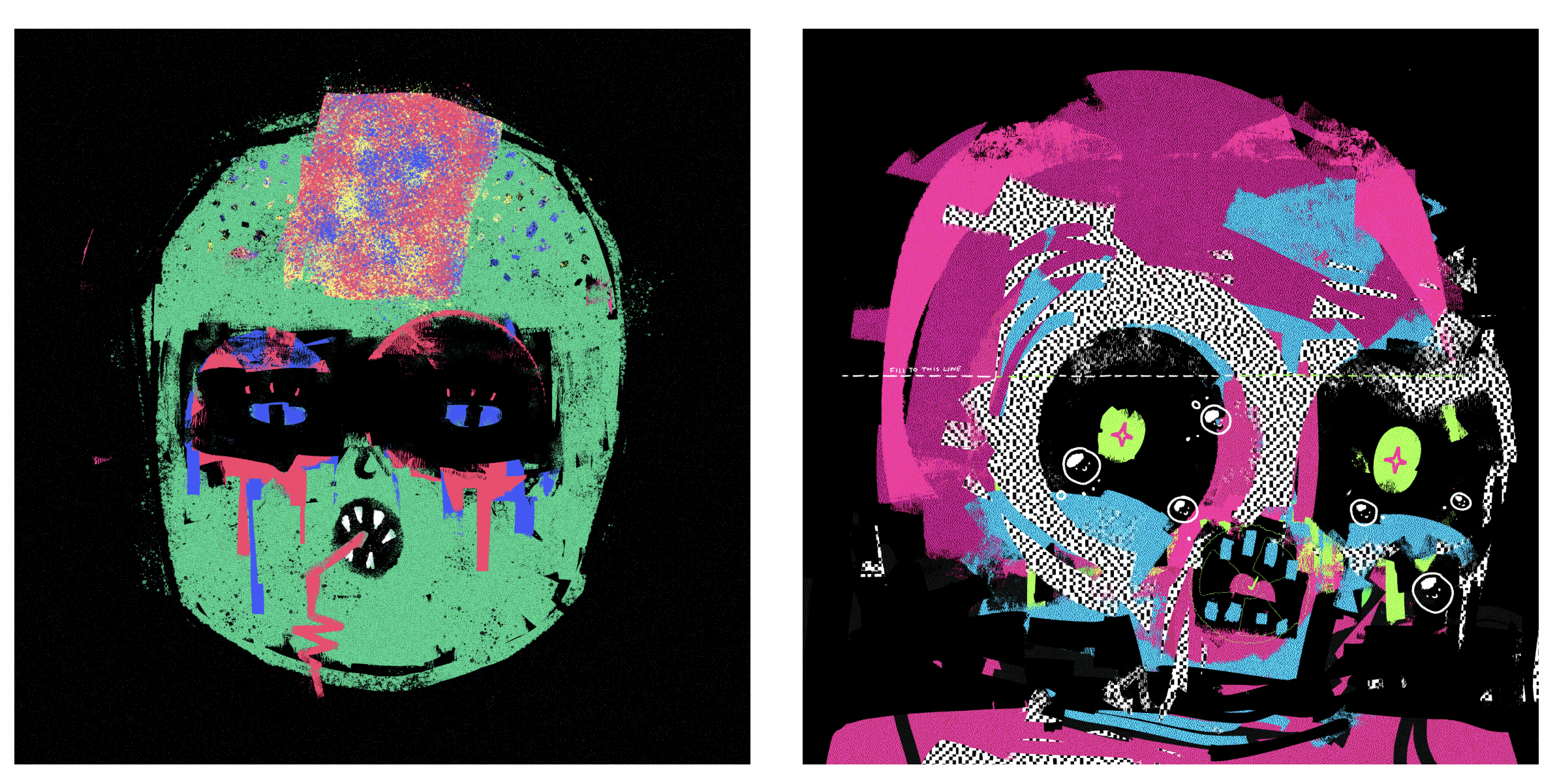

XCOPY — crypto‑native time capsule

Why it matters: XCOPY reads like a seismograph of internet cycles—volatility, memento mori, gallows humor—rendered in glitch aesthetics with high memetic density. It’s cultural memory more than checklist art, which is why it resonates natively onchain.

What we look for: edition context, historic drop significance, metadata permanence, and community mindshare.

Note: We’re also members of DoomDAO (the largest collective of XCOPY collectors and shared works); membership is represented by a unique NFT.

Pricing, liquidity, and horizon (be honest with yourself)

Let’s address the obvious counterpoints:

Correlated to liquidity: Absolutely. NFTs are reflexive and cyclical. That’s not a bug; it’s the macro environment speaking through risk assets.

Illiquid by design: Floors can gap. Time‑to‑liquidity is measured in weeks or months, not minutes. Size positions accordingly.

Not for short‑term flipping: We think of top‑tier NFTs as long‑duration cultural assets. The power law lives here. The goal is to survive the path and capture the tail.

How we underwrite entries:

Canon first: benchmarks (Punks), culture leaders (XCOPY), and a few high‑conviction emergents.

Provenance integrity: artist/contract, mint location, metadata permanence, historical context.

Community depth: holders, curators, museum interest, builder mindshare.

Blockspace quality: where the work is anchored, and how upgrade/bridging risks are handled.

Portfolio framing: Think like a museum endowment, not a degen terminal. Accumulate, don’t chase. Trim into manic phases; add in boring ones.

Why this matters to investors

For FTC, collecting onchain isn’t a flex—it’s applied research. We want to learn in public, record our priors, and refine them against real markets. The gallery is where we do that: a transparent ledger of taste, thesis, and mistakes.

Skin in the game: We invest with our own balance sheet and size positions for illiquidity. We will disclose when we own a work we discuss, along with entry dates and any changes.

The objection I hear most: “Isn’t this all just… monkey JPGs?”

Some of it is. Some of it always will be. But that misses the point. The internet has always sorted signal from noise through networks, not gatekeepers. NFTs give networks better tools: shared ledgers, enforceable scarcity, programmable rights, and composable distribution. That’s not a hype cycle—that’s infrastructure for culture.

If you only take one idea from this post

AI commoditizes content; onchain crystallizes culture and identity into asset form.

The rest—prices, narratives, cycles—are just the weather.

One diagram (inline)

Close

If this resonates—or especially if it doesn’t—kick the tires. Tell me where the thesis breaks. Then browse the FTC Gallery on Deca. I’ll keep annotating pieces and updating the playbook as we learn.

Further reading: Punk6529 on cultural significance and the open metaverse (start here: https://x.com/punk6529/status/1429399888786333697). Hat tip to the broader “networked art as store of wealth” framing popularized in recent cycles.

SKIN IN THE GAME

How we’re expressing the networked-art thesis right now.

Asset | Entry (yr) | Sleeve | Rationale |

|---|---|---|---|

CryptoPunks | 2021-23 | Core (Identity Primitive, Crypto-Native Art) | Benchmark onchain identity; scarce, verified provenance; reference index for digital culture. |

Fidenza | 2021 | Leader (Gen-Art Canon) | Museum-ready generative art; recognizable system; strong onchain provenance; cultural staying power. |

Chromie Squiggle | 2021 | Leader (Gen-Art Canon) | Early Art Blocks standard; parameter diversity; community consensus; reliable onramp to gen-art. |

XCOPY (select works) | 2021-24 | Leader (Crypto-Native Art) | Memetic, time-stamped onchain practice; category leader; DoomDAO member with shared collection exposure |

Informational only, not investment advice.