🗓️

2025

Build Useful Things

⚡ In A Rapidly Changing World

ⓘ What is this?

TURN SIGNAL — First Turn (Build)

Summary: The market is shifting from speculation to useful products. LLMs + onchain rails (wallet-as-login, stablecoin payments, onchain receipts) let small teams ship production-grade assistants and services. Distribution is social-first; provenance and identity live in wallets.

Heat: 8/10 • Vector: Tailwind

Catalysts: affordable foundation models; agent frameworks maturing; wallet UX upgrades; ETH/L2 settlement for consumer apps; stablecoin adoption; enterprise pilots with onchain registries

Risks: platform/API churn; model costs and reliability; data/privacy compliance; app‑store policies; wallet/account‑abstraction fragmentation; regulatory overhang.

Hook. “Safe yield” ≠ safe purchasing power. The sticker rate on government bonds, mortgage‑backed bond funds, money‑market funds, or insured deposits can look fine, yet if inflation and the term premium—the extra yield investors demand for lending long—stay elevated, a 4–5% coupon can still leave you behind after inflation. In that world, spread‑collectors and fee layers compress; teams that actually drive down hard costs—settlement, compute, logistics, even labor—compound.

Thesis. In the First Turning, cheap‑money extraction is getting repriced; compounding shifts to productive builders who expand real supply and destroy rent pools with efficiency—onchain rails and AI/robotics that convert scarcity into service.

Why now (cycle & catalysts)

Two shifts are happening at once.

The "safe income" stack is wobbling. Downtown office towers are the obvious canary, but the pattern is broader: bond coupons that trail inflation, equity stories that lean on buybacks over real growth, and fee‑takers protected by distribution, not product. A "safe" 4–5% coupon can still lose ground after inflation; a building at ~55% utilization can’t refinance on yesterday’s debt math. As these loans reset, losses spill to banks and, eventually, to governments—weakening confidence in their debt and pushing investors to demand more yield.

Maturity walls are forcing reality checks. Debt written in the zero‑rate era is rolling into a higher‑rate world. Refinancings reveal who was surfing cheap money and who can produce cash flow at today’s costs.

Add a stickier term premium (the extra yield for lending long) and persistent deficits that need financing, and the practical takeaway is simple: your real hurdle is higher than the headline rate suggests. Price risk—and opportunity—accordingly.

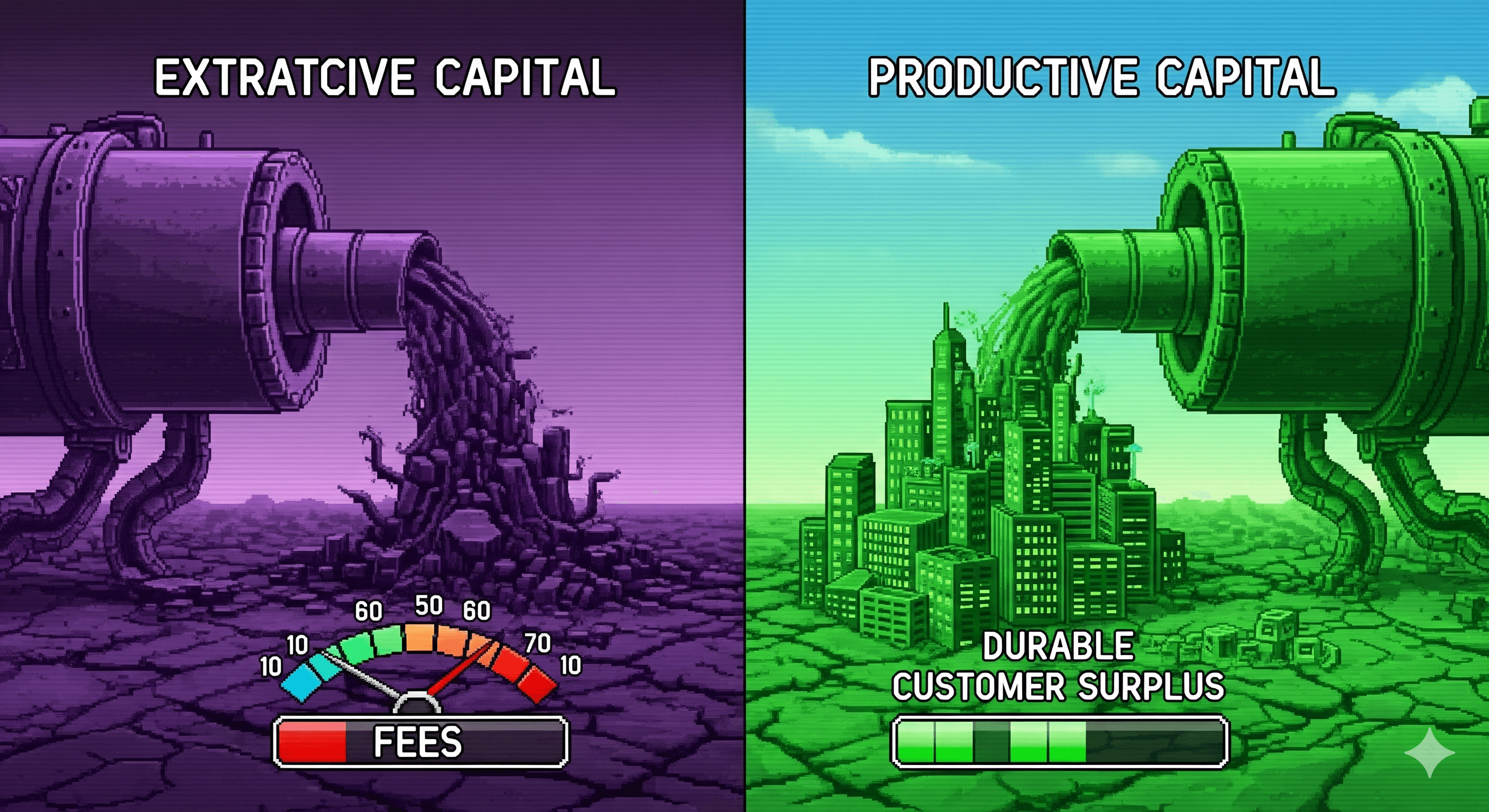

Productive vs. extractive capital (framing)

Call it productive vs. extractive capital. Productive capital reinvests into new supply: faster settlement, cheaper compute, fewer middlemen, more reliable delivery. Extractive capital borrows to sit atop tollbooths. For a decade, zero rates made extractive look smart. With a higher real hurdle, extraction becomes a melting ice cube; productivity becomes a flywheel.

This frame isn’t a moral lecture; it’s an operating rule. If a dollar you deploy doesn’t raise capacity or reliabilitysomewhere in the stack, model it as temporary—fragile and ripe for disruption in this period of change.

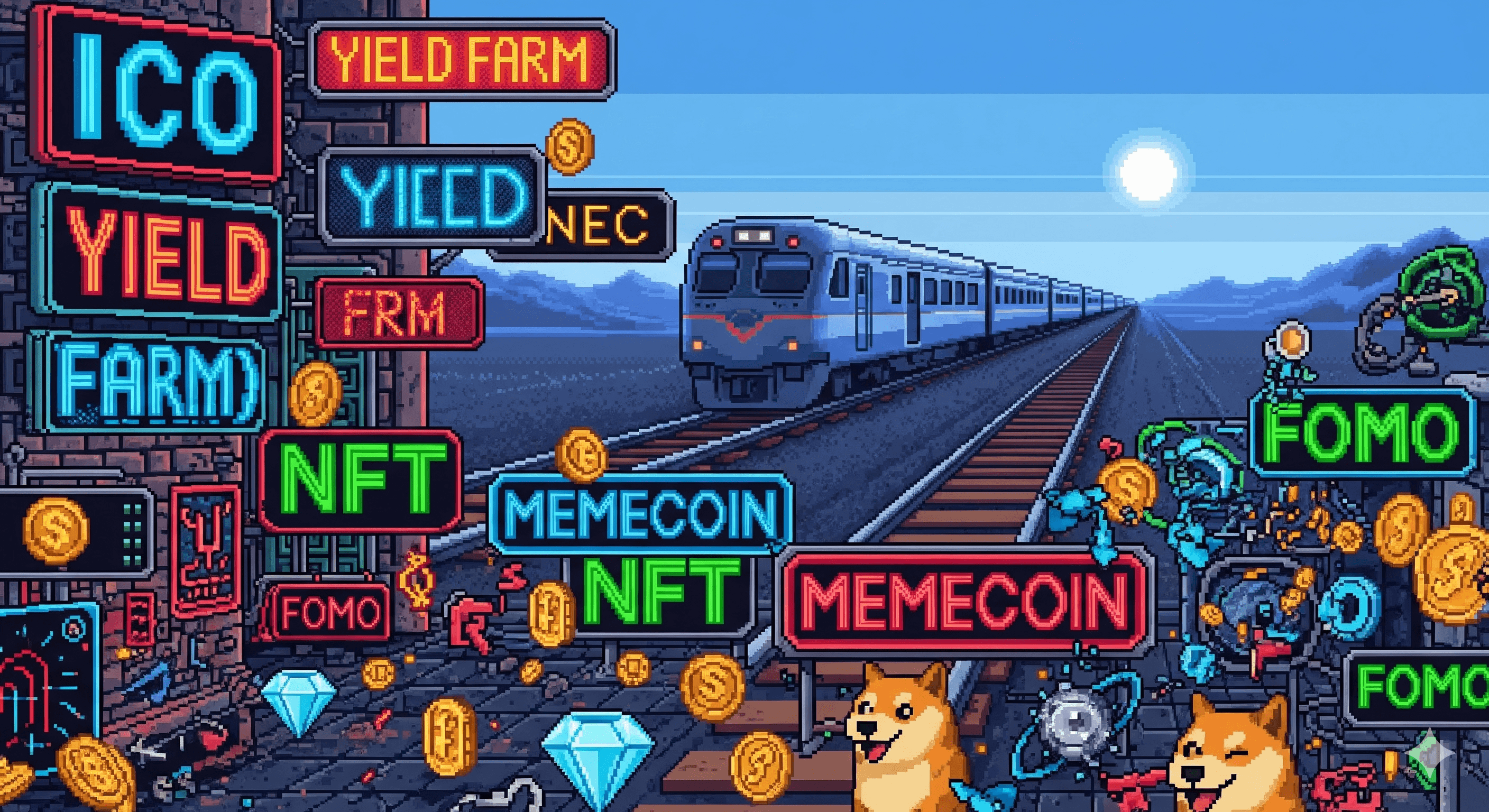

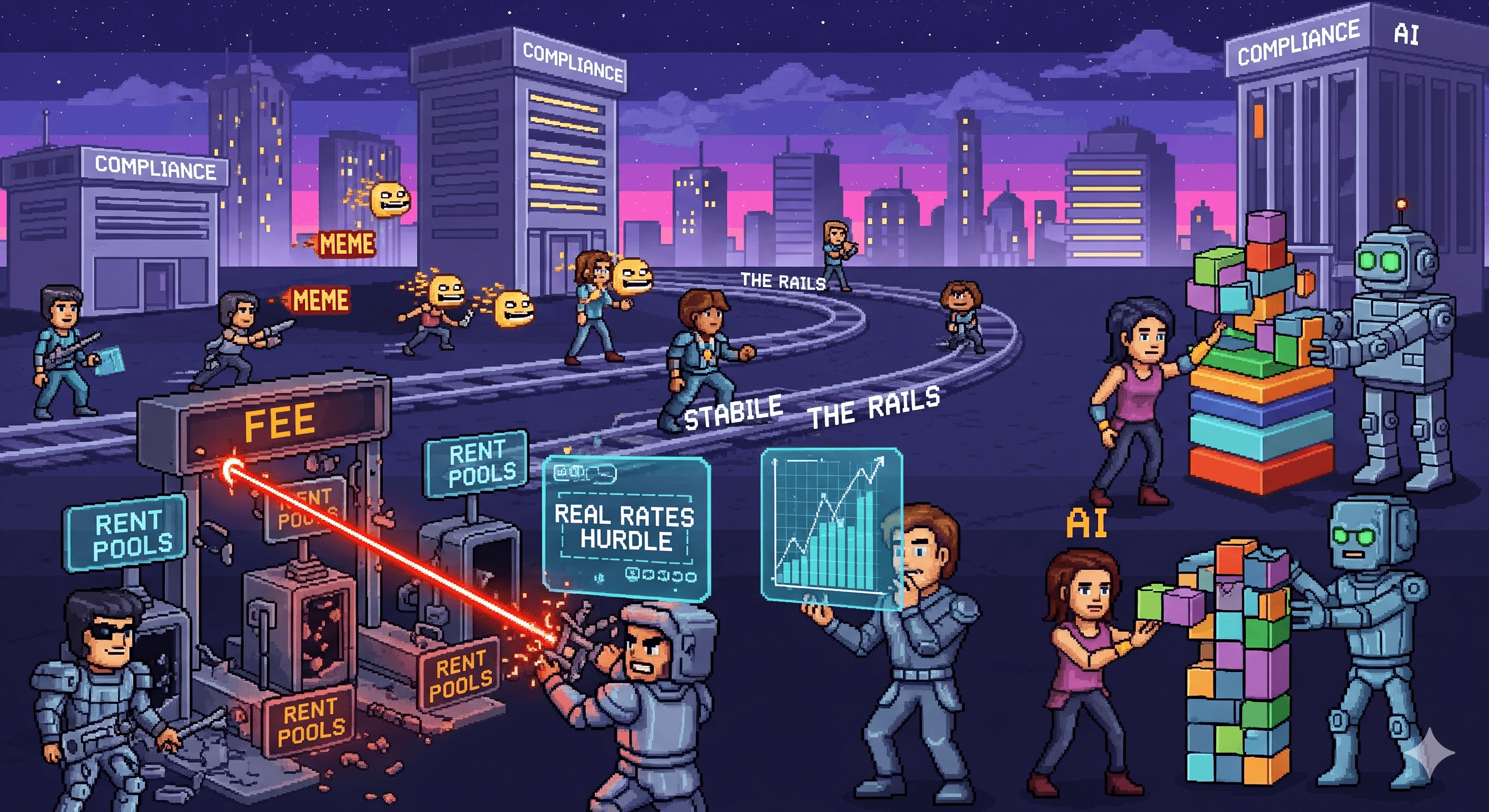

Hype blinds; infrastructure wins

Cycles rhyme. The attention magnets shift, but the rails keep compounding in the background. In crypto alone, each hype era masked the boring infrastructure that later mattered: ICO froth while real DeFi primitives were being assembled; yield‑farm mania while NFTs and creator monetization matured; L1 shilling while stablecoin rails quietly became the checkout button; memecoin casino while coordination markets gained traction.

A falsifiable posture: follow usage and volume rather than narratives. Prediction markets are a clean current example—regardless of your view, sustained growth in liquidity and users signals real product‑market fit beneath the timeline noise.

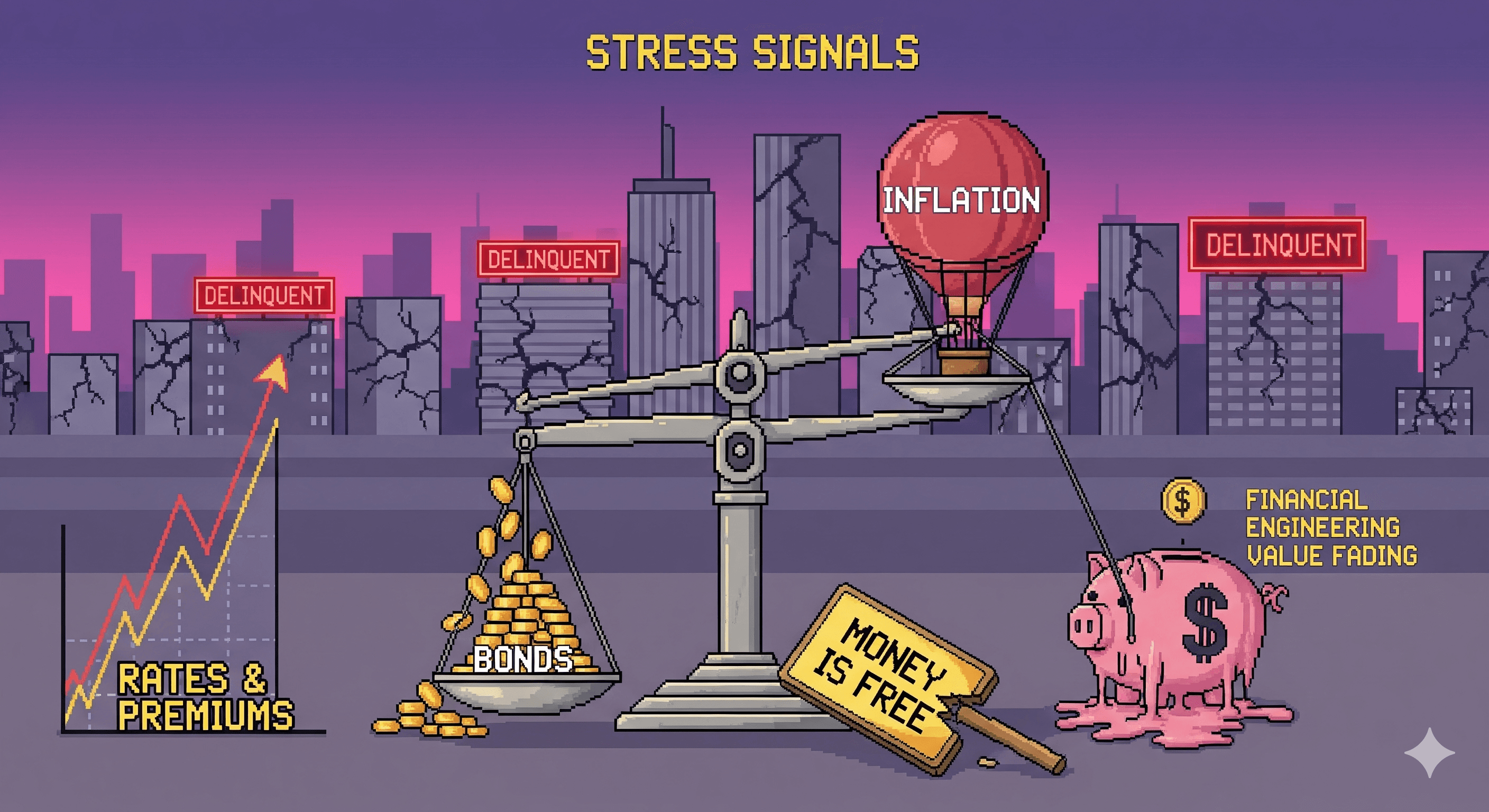

Old system: stress signals to watch

Office use vs. debt don’t match. Keycard swipes are ~50–55% of pre‑2020 levels, so many buildings can’t support yesterday’s loan terms. That’s why delinquencies and “extend & pretend” (short‑term extensions to avoid recognizing losses) are rising.

“Safe” bonds aren’t safe in real terms. Governments are issuing more debt while natural buyers step back. If coupons trail inflation and the term premium, you’re losing purchasing power even while “earning” yield.

Financial‑engineering value is fading. Low‑growth, buyback‑driven equities screen cheap until you price a higher real hurdle. Cash flows that don’t add capacity get discounted.

Rates & term premium are back. Long‑dated bonds now require extra compensation; don’t build models that only work when money is free.

New system: capital (the ledger) & labor (the robot)

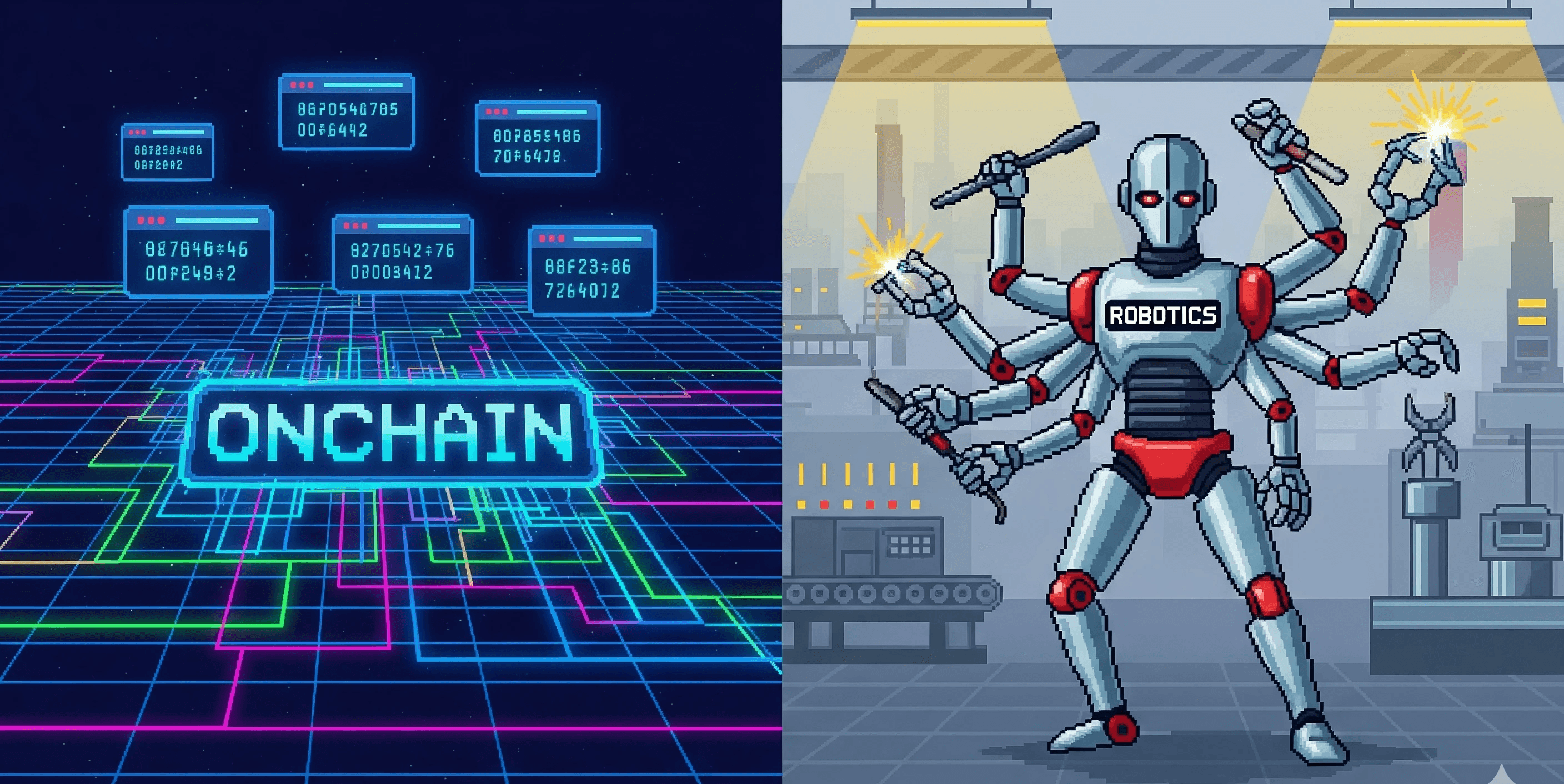

Capital — the ledger is moving onchain

If money is the ledger that coordinates energy, then onchain is the upgrade path—programmable, auditable, composable, and less rent‑heavy. It lowers settlement risk/cost, collapses intermediaries, and enables new credit/identity primitives. Not sexy; deeply compounding.

Labor — the robot becomes the substrate

In parallel, labor’s substrate is beginning to shift. Tesla’s positioning—management has said it could be Tesla’s most valuable product line and is already piloting factory tasks—around Optimus isn’t just showmanship; it signals robotics as a future value driver with early deployments and aggressive targets. You don’t need the exact timelines to price the direction: automation that is cheaper, safer, and more reliable for repetitive tasks will be adopted. Build for that world.

How information spreads — real‑time feeds set the pace

News and ideas now spread through real‑time feeds, not just a few newsrooms. That removes old gatekeepers and speeds up coordination (discovery, markets, movements), but also concentrates power in whoever runs the feed. Bottom line: faster bottoms‑up adoption with a new centralization risk—design go‑to‑market with both in mind.

Playbook (actionable)

Target rent pools. Build products that replace embedded fees in payments, custody, identity, compliance, and settlement. Your pricing power comes from removing intermediaries and errors, not from re‑creating them.

Price to the hurdle. Model returns against real rates + issuance risk, not just CPI. If your IRR only works at zero term premium, it doesn’t work.

Own the rails, not the meme. Prefer infrastructure with durable usage/volume signals (stablecoin settlement, coordination markets with real liquidity) over attention spikes.

Bridge AI → atoms. Back teams where AI/robotics drop unit labor or defect rates in logistics, manufacturing, field ops—places with measurable KPIs in months, not years.

Policy‑aware distribution. Aim for markets that are newly possible (custody, stablecoins, RWAs). Ship with compliance primitives from day one.

Signals we track

CMBS office delinquency trend vs. “extend & pretend” cadence.

Office utilization (Kastle 10‑city Back‑to‑Work Barometer).

10‑year UST and term‑premium regime (FRED DGS10).

Onchain coordination markets (e.g., Polymarket volumes/users).

Robotics deployment disclosures (factory pilots, throughput data).

Close

In every regime change, the temptation is to fight the denominator or chase the carnival. The better move is boring: build useful things that clear a real hurdle and remove friction. In a world repricing extraction, productivity is the alpha.

SKIN IN THE GAME

How we’re expressing the “build useful things” thesis right now.

Asset | Entry (yr) | Sleeve | Rationale |

|---|---|---|---|

ETH | 2021 | Core (Rails) | Settlement + identity rails for consumer apps; L2 distribution with L1 provenance; deep dev mindshare. |

BTC | 2020 | Core (Reserve) | Neutral reserve collateral; store-of-value narrative; debasement hedge. |

TSLA | 2022 | Leader (AI + Robotics/AV) | Full-stack autonomy (perception → planning → actuation), in-house compute; bridges AI into useful physical products. |

COIN | 2022 | Leader (Onramp/Custody/Compliance) | Regulated fiat↔onchain rails; custody + compliance primitives; infra for consumer/enterprise distribution. |

RKLB | 2024 | Emergent (Space Infra) | Verticalized launch + space systems enabling orbital data/comm networks and machine-to-machine markets. |

TAN (Solar ETF) | 2025 | Thematic (Energy/Infra) | Solar value-chain exposure; falling capex & policy tailwinds; electrification + AI/data-center demand make cheap, abundant power strategic infrastructure. |

Informational only, not investment advice.