🗓️

2025

Why We Started FTC

Not a fund launch—just a working notebook you’re invited to read.

We’ve been looking for a simple, honest answer to the question, “So what are you working on?” First Turn Capital (FTC) is our answer. It’s a research‑first family office—a place to publish what we’re learning, build real relationships, and make the occasional principal investment when we can materially help. We’re not chasing deal flow, or raising outside capital. We’re building a durable container for curiosity, clarity, and contribution.

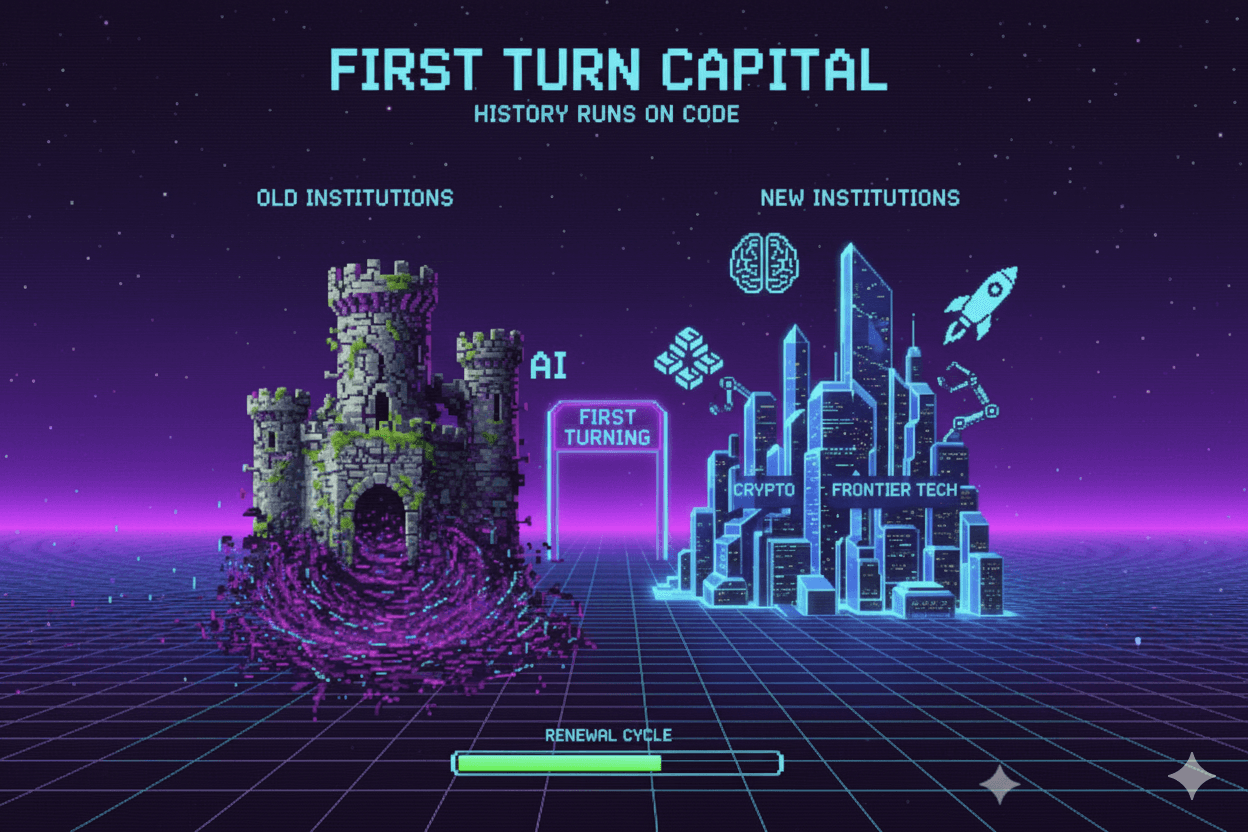

Why this, why now

We’re in the early innings of core digital institutions being rebuilt on open rails—AI and crypto. Here are five:

From | Moving To | Why It Matters | |

|---|---|---|---|

Global identity & money rails | platform logins, KYC silos, bank hours | portable, verifiable credentials; stablecoin settlement with instant finality | one global market; lower frictions; broader access |

Autonomous mobility & robotics | ADAS pilots; point solutions in warehouses | AI‑driven fleets & robots with wallets—perceive, plan, and pay; onchain tolls/insurance/maintenance | safer logistics; continuous service; machine‑to‑machine markets |

Ownership, provenance & tokenization | file copies; platform‑dependent rights | onchain provenance; portable creator royalties; real‑world assets onchain | interoperable ownership; automated payouts; new asset access |

Autonomous agents & operations | scripted support; manual ops | agents with wallets that verify, pay, refund, reship, and orchestrate logistics | lower costs; 24/7 coverage; fewer errors |

Personalized education & work | one‑size‑fits‑all systems | AI tutors & copilots that adapt pace, explain, and automate workflows | better outcomes; meaningful productivity lift |

This is still early—but it’s already changing how we live.

At the same time, we’re late‑cycle in the incumbent playbook: fees creep up, take rates harden, gatekeeping spreads, regulatory capture ossifies rules, rent‑seeking proliferates, and “platform risk” grows—classic extractive behavior. Fourth Turning generational shifts and liquidity cycles help explain why renewal arrives in bursts: as trust erodes and incumbents harden moats, new open rails become viable and a “first turning” rebuild begins.

On top of that, debasement and inflation are incumbency’s last move and a silent tax on capital. We underwrite an 11–13% real hurdle and work around it by funding builders who reduce take rates, bypass gatekeepers, and create durable customer surplus—net of fees, taxes, and slippage.

At First Turn Capital, we identify, research, and selectively invest in the primitives of tomorrow’s institutions—then add value with skin in the game where it matters.

What FTC looks like right now

A research‑first publishing project at the intersection of macro (liquidity, debt cycles, and Fourth Turning generational shifts) and AI × crypto.

A home for thoughtful conversations with founders and co‑investors.

Selective investments when our help is clearly material—GTM, distribution, product or positioning.

Focus areas (working list)

Identity & trust rails: wallets, verifiable credentials, fraud/abuse prevention.

Stablecoin & settlement infrastructure: on/off-ramps, merchant & B2B payments.

AI × crypto agents: coordination, incentives, data markets, inference marketplaces.

Digital culture & collectibles: NFTs and onchain media as loyalty/provenance rails; community economies; internet-native brands.

Creator/consumer ownership: real utility around gaming, media, marketplaces.

User‑aligned business models: tokenized cash, usage‑based & revenue‑share pricing, protocolized margins (lower take rates).

What founders get (lightweight, high‑signal)

Fast read and crisp feedback—even if we pass.

Monthly office hours for GTM, pricing, onboarding, and narrative.

Selective intros (co‑investors, early customers, creators) when there’s real alignment.

If you’re building in these areas and the “productive > extractive” filter resonates, we’d love to compare notes.

What we’re trying to learn

Where AI agents actually need identity, payments, and custody to create new value.

How stablecoin rails change unit economics for global software businesses.

Practical designs that reduce take rates while increasing market size.

New playbooks for distribution that don’t rely on hype cycles.

We’ll publish essays and memos—some polished, many not. The goal isn’t reach; it’s clarity, conversation, and lasting insight.

How to engage

Read a post, DM us, or email a short note with what you’re building.

If we’re a fit, we’ll keep it simple: fast feedback, a focused working session, or (sometimes) a small principal check.

A small note on scope and compliance

First Turn Capital is a research-first family office. We invest personal/principal capital selectively and do not offer investment advisory services to the public. Nothing here is an offer to sell or a solicitation to buy any security. If that ever changes, we’ll say so plainly.

For informational purposes only.

If this resonates, reach out—we’d love to connect.